Article content

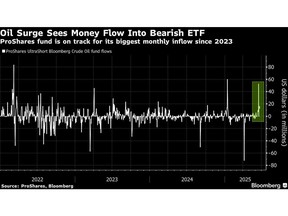

(Bloomberg) — An exchange-traded product that profits when oil prices fall is on track for its biggest monthly inflow since 2023 as investors correctly wagered that crude’s conflict-driven spike would prove short-lived.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The ProShares UltraShort Bloomberg Crude Oil ETF pulled in cash in eight of the last nine sessions for which data are available, putting it on track for a monthly inflow of $121 million, according to data compiled by Bloomberg. The fund seeks to return twice the inverse of the daily performance of its underlying index.

Article content

Article content

Article content

Oil prices have plummeted more than 10% over the past two sessions as a fragile detente between Israel and Iran reduced the risk to flows from the Middle East. While prices spiked at the onset of Israel’s bombing campaign, the escalation hasn’t materially affected oil exports. Iran’s retaliation spared energy infrastructure, and volumes through the Strait of Hormuz have continued as normal.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

As crude rallied this month, investors piled into the fund, sparking its biggest daily inflow since January in a bet that the supply scare would be the latest false alarm caused by the 20-month war. Selling oil’s geopolitical spikes has generally proved a successful trading strategy in recent years.

Article content

The fast-evolving Middle East conflict pushed several gauges of volatility to yearly highs, catching the eye of sophisticated and generalist investors alike. The frenzy saw volumes of futures and options break several records, while oil’s bullish premium at one point soared to levels not seen since Russia’s invasion of Ukraine in 2022.

Article content

Advertisement 1

.jpg) 10 hours ago

1

10 hours ago

1

English (US)

English (US)