Article content

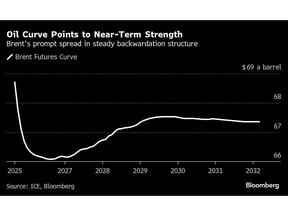

(Bloomberg) — Oil slipped for a third day on nascent signs of a softening physical market, as traders assess the likelihood of a glut in the second half of the year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

West Texas Intermediate futures fell by as much as 1.7% to trade near $68 a barrel after a weekly report from the US Energy Information Administration showed inventories at the key storage hub in Cushing, Oklahoma, rose to the highest since June, while US distillate demand ticked down. At the same time, crude inventories fell by 3.86 million barrels.

Article content

Article content

Article content

Traders and analysts remain preoccupied with the prospect of an oversupply later this year, as global demand growth cools, the OPEC+ alliance fast—tracks the return of halted supplies and output across the Americas booms. Price gauges indicate that availability is tight for the time being, with a premium of $1.06 cents on the US benchmark’s prompt spread, and US distillate inventories, which include diesel, sitting at the lowest level since 1996 seasonally.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Oil has ticked higher this month — building on the upward trend since May — despite concerns that US President Donald Trump’s tariff onslaught will hurt demand and that plans by OPEC+ to rapidly continue reviving supplies may result in a glut. Earlier this week, Goldman Sachs Group Inc. raised its Brent forecast for this half, although it remained cautious about 2026.

Article content

While global crude inventories have been swelling in recent months, the bulk of the accumulation has come in markets that have relatively little impact on futures prices, according to Morgan Stanley. The premiums traders are paying for more immediate supplies, a pattern known as backwardation, signal strong short-term demand.

Article content

“The Brent futures curve remains firmly in backwardation across the first four-to-six months — a structure that usually points to market tightness,” Morgan Stanley analysts including Martijn Rats said in a note, which highlighted what they described as an uneven distribution of inventory increases. “The builds have been in the Pacific, but Brent is priced in the Atlantic,” they said.

Article content

—With assistance from Yongchang Chin and Catherine Cartier.

Article content

Advertisement 1

.jpg) 8 hours ago

1

8 hours ago

1

English (US)

English (US)