Article content

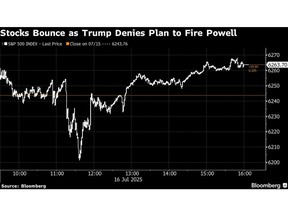

(Bloomberg) — Asian equity-index futures struggled for direction Thursday after the dollar weakened and US stocks rose in volatile trading after President Donald Trump played down the prospect he may soon fire Jerome Powell.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Trump said he is “not planning on doing anything” to remove Powell, after a White House official said the president was likely to seek the Federal Reserve Chair’s ouster soon. The initial speculation sent the dollar, US stocks and Treasury yields downward before Trump’s clarification soothed market fears.

Article content

Article content

Article content

Contracts for the S&P 500 fell 0.2% in early Asian trading Thursday after the index ended 0.3% higher Wednesday. A 0.1% gain for the Nasdaq 100 sent the tech-heavy benchmark to a new closing high. A gauge of the greenback fell 0.3%, ending a four-day run of gains. Japanese equity futures fell early Thursday, while those for Australia and Hong Kong rose.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Treasury two-year yields fell five basis points and the 10-year yield fell three basis points. The moves were helped along by softer-than-estimated US producer prices, which reinforced bets on Fed rate cuts this year.

Article content

The trading action Wednesday hints at how Wall Street would react if Trump actually removed Powell — a prospect that strategists warn would rattle global markets. Trump has repeatedly assailed Powell as the Fed has held off on cutting rates amid concern that tariffs may spur inflation. Trump and his allies have also lambasted the Fed chair over the cost of a renovation of its Washington headquarters.

Article content

“After the president’s subsequent backing off on remarks to remove Powell, the immediate crisis may have passed, though we doubt we are entirely done with this saga,” said Michael Feroli at JPMorgan Chase & Co.

Article content

Article content

In tariff news, Trump dialed down his confrontational tone with China in an effort to secure a summit with counterpart Xi Jinping and a trade deal. Trump also said he would send letters to more than 150 countries notifying them of tariff rates and that the levies imposed could be 10% or 15%.

Article content

Read: What Firing Powell Would Cost the US Economy

Article content

Top bosses at some of Wall Street’s biggest banks emphasized the importance of an independent Fed.

Article content

Bank of America Corp.’s Chief Executive Officer Brian Moynihan and Goldman Sachs Group Inc.’s David Solomon joined JPMorgan’s CEO Jamie Dimon in stressing how critical the Fed’s autonomy is. Moynihan said in an interview with Bloomberg TV on Wednesday that the Fed was “set up to be independent.”

Article content

The Fed’s independence is “absolutely critical,” Dimon at JPMorgan said on a conference call Tuesday. Meddling with the Fed “can often have adverse consequences,” he noted.

Article content

A Trump dismissal of Powell would be an underpriced risk that could trigger a selloff in the dollar and Treasuries, Deutsche Bank AG’s George Saravelos recently said. If Trump were to force Powell out, the subsequent 24 hours would probably see a drop of at least 3% to 4% in the trade-weighted dollar, as well as a 30 to 40 basis point fixed-income selloff, he said.

.jpg) 9 hours ago

1

9 hours ago

1

English (US)

English (US)