Article content

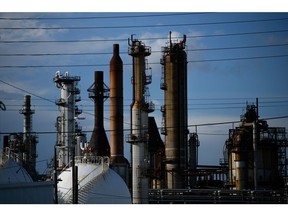

(Bloomberg) — Oil rebounded from the biggest two-day decline since 2022 as President Donald Trump downplayed prospects of near-term sanctions relief for Iran and a government report showed a large drop in US crude stockpiles.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

West Texas Intermediate rose more than 1.5% to trade above $65 a barrel, after slumping 14% over the past two days. Trump said the US would hold a meeting with Iran next week, but maintained that he is “not giving up” a maximum-pressure campaign targeting Tehran’s petrodollars. Still, he declared the tensions in the region as “over.”

Article content

Article content

Article content

Elsewhere, US government data showed the country’s crude inventories fell for the fifth straight week, dropping by 5.8 million barrels to sit at an 11-year seasonal low. The data bolstered WTI’s prompt spread — the difference between its two nearest contracts — to $1.39 a barrel in backwardation, a bullish structure that signals a tight near-term market.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Today’s move in crude looks like a combination of factors: a technical bounce after an oversold selloff, a walk-back of yesterday’s surprise comments on Iranian sanctions, and supportive EIA data,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “While the second-half outlook still points to a surplus, and bearish sentiment remains, near-term balances look tighter than the broader narrative suggests.”

Article content

Trump’s comments appeared to reverse his remarks on Tuesday giving China, Iran’s biggest crude customer, the green light to carry on buying its oil. The announcement on social media — which baffled investors and government officials alike — signaled a policy shift that could undermine years of US sanctions against Tehran.

Article content

Article content

Still, the dust is beginning to settle in a global oil market that has been on a wild ride this week, marked by the biggest daily price swing in almost three years. The rocky trading has been amplified by huge trading volumes in options markets, while the closely-watched oil futures curve has also returned to its pre-war levels.

Article content

The OPEC+ alliance is due to hold discussions on July 6 to consider a further supply boost in August. Meanwhile, Trump’s self-imposed deadline to reach trade deals with major US partners falls on July 9. Nations without an accord in place will face the so-called “Liberation Day” tariffs.

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)