Article content

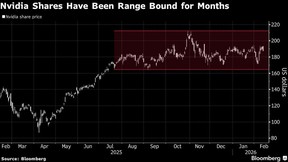

Big Tech keeps raising its spending plans for artificial intelligence infrastructure, yet shares of Nvidia Corp., one of the biggest beneficiaries of that flood of cash, have been largely stagnant for months.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The stock is down more than one per cent since the beginning of the fourth quarter and has been largely range bound despite hitting a record high in late October. It’s also lagging the S&P 500 Index to start 2026, a slowdown from Nvidia’s nearly 40 per cent leap in 2025 following two consecutive years of triple-digit percentage gains. Nvidia shares sank as much as 2.6 per cent Friday.

Article content

Article content

Article content

Even ballooning capital spending from Meta Platforms Inc., Alphabet Inc., Microsoft Corp. and Amazon.com Inc. — estimated to exceed US$600 billion in 2026 — hasn’t been enough to meaningfully boost the stock amid increasing anxieties about returns on those investments.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“There is perhaps growing concern that the ultimate revenue from AI will simply not keep up with the capex spend that’s been announced,” said JoAnne Feeney at Advisors Capital Management, adding that more spending now raises the probability that the market will reach satiation faster. It’s “going to move up the date at which they pause and let the new compute be digested.”

Article content

The cyclical nature of the chip industry is baked into Nvidia’s valuation, which has compressed as revenue growth is expected to slow in the coming years. Sales are projected to expand 58 per cent in the current calendar year and 28 per cent in 2027, according to data compiled by Bloomberg.

Article content

Nvidia shares trade around 24 times profit estimates, roughly in-line with the Nasdaq 100 index and a slight premium to the S&P 500. Even though this price-to-earnings ratio is far below the five-year average for the stock at 38 times, investors aren’t counting it as a discount.

Article content

Article content

Valuations for infrastructure providers like Nvidia are likely to move lower as growth in capital spending decelerates, according to UBS strategists led by Ulrike Hoffmann-Burchardi.

Article content

Article content

Article content

“Capex growth is likely to moderate from these levels, which could improve investor perceptions of those doing the spending, but is a potential negative for some companies in the enabling layer,” they wrote in a note dated Feb. 10.

Article content

The next catalyst for Nvidia shares is its upcoming earnings report, due Feb. 25 after markets close. Investors will be focused on Nvidia’s guidance and demand for chips, which have accounted for a large chunk of hyperscaler spending in recent years.

Article content

“It really does just come down to the valuation and how rich the company already is,” said Shelby McFaddin, an investment analyst at Motley Fool Asset Management. Investors want to “wait a second and actually see what Nvidia has to say about it before we reward them.”

Article content

Wall Street analyst estimates for Nvidia’s revenue and earnings in 2026 have barely budged since the tech giants revealed their mega-spending plans. Of course, analysts are likely waiting to hear from Nvidia before making changes to their models.

Article content

After a big stock run up like Nvidia has had, it’s natural for there to be a period of consolidation, but sentiment can change rapidly, said Jim Thorne, chief market strategist at Wellington-Altus.

Article content

“It’s psychology,” Thorne said. “All of a sudden everybody believes the story and the stock goes crazy up.”

Article content

—With assistance from Eric J. Weiner and Matt Turner.

Article content

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)