Article content

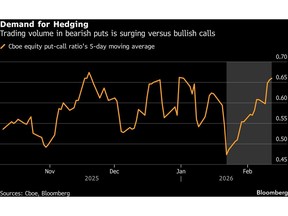

(Bloomberg) — Wall Street entered 2026 all-in — record-low cash, minimal hedging, maximum conviction. Six weeks later, a slew of consensus trades are misfiring.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

AI was supposed to be the can’t-miss trade. Instead, it became the threat — not to the companies building it, but to the asset-light businesses it could replace. Software firms, wealth managers, brokers, tax advisers — across the white-collar world, a decade of margin expansion repriced in weeks, sending shock waves through private debt markets loaded with loans to the same companies.

Article content

Article content

Article content

This week crystallized the damage. The S&P 500 headed for its worst stretch since November before Friday’s rebound on a benign inflation print, with AI disruption fears cascading through markets of all stripes.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

But the pain didn’t stop at stocks. Gold whipsawed, briefly dipping below $5,000 Thursday before recovering to end the week higher. Silver swung 11% in a single session. Bitcoin, still nearly half off its October high, briefly sank below $66,000. Even in credit, the consensus bet broke down: junk bonds, while roughly flat, lagged investment grade by the widest margin in months. Across asset classes, the favored trades are losing to the unfavored ones — fast.

Article content

Two forces are making it worse. One is positioning. Bank of America Corp.’s January investor survey found cash at a record low of 3.2%, with nearly half of managers holding no downside protection, the least since 2018. The other is the web of leverage linking seemingly unrelated portfolios, where a liquidation in one corner fuels selling in another.

Article content

The trades nobody wanted — energy, staples, Treasuries — are leading the year. The favorites are trailing the underdogs. The consensus coming into 2026 has gone wrong in six weeks flat. The crowding that caused it is putting portfolio managers on high alert.

Article content

Article content

“The big risk here is additional vol-shock type episodes,” said James Athey, a portfolio manager at Marlborough Investment Management. “Everything looks highly correlated and thus selling in one asset can force selling across the others.”

Article content

Years of stable asset relationships have emboldened money managers to double down on their positions. According to a model designed by Jordi Visser at 22V Research, market co-movements are surging even as the Cboe Volatility Index, or VIX, remains subdued and the S&P 500 holds above its 50-day average — a combination he reads as market stress hiding beneath a calm surface. In the past two years or so, such stress signals fired up about once every month. Fewer than two months into this year, there have been a dozen.

Article content

Angst resurfaced this week as the threat of AI disruptions claimed new causalities in the stock market almost daily. The VIX surpassed the widely watched level of 20. While the reading showed no signs of panic, the market demonstrated a clear desire for safety — hitting the risk-on crowd.

Article content

An ETF tracking investment-grade bonds (LQD) had its best week since October relative to its high-yield counterpart (HYG), extending its lead for the year. That’s bad news for fund managers, who according to BofA’s survey, were favoring riskier debt for the first time in four years.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)