Article content

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

HALIFAX, Nova Scotia, Nov. 06, 2025 (GLOBE NEWSWIRE) — NOVA LEAP HEALTH CORP. (TSXV: NLH) (“Nova Leap” or “the Company”), a growing home health care organization, is pleased to announce the release of record financial results for the quarter ended September 30, 2025. All amounts are in United States dollars unless otherwise specified.

Article content

Article content

Article content

During the quarter, Nova Leap achieved the following record results:

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

- Record consolidated quarterly revenues;

- Record consolidated gross margin;

- Record consolidated Adjusted EBITDA;

- Record Canadian operating segment revenues;

- Record Canadian operating segment gross margin;

- Record Canadian operating segment Adjusted EBITDA;

- Record U.S. operating segment revenues;

- Record U.S. operating segment gross margin; and

- Record U.S. operating segment Adjusted EBITDA.

Article content

Nova Leap Q3 2025 Financial Results

Article content

Financial results for the third quarter ended September 30, 2025 include the following:

Article content

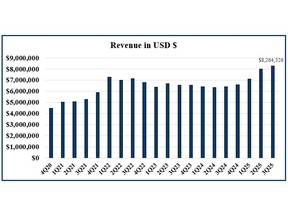

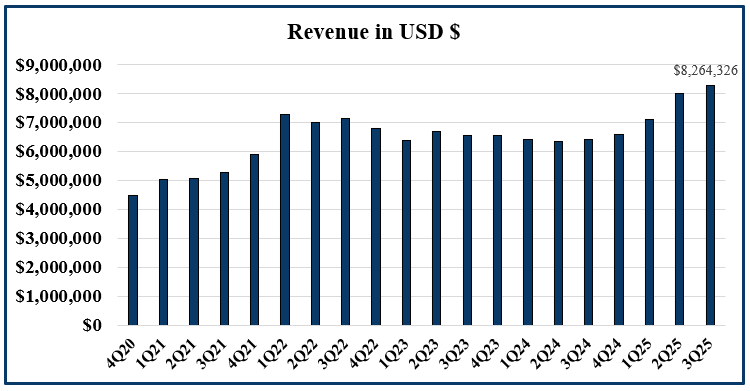

- Q3 2025 revenues of $8,264,326 increased by 3% relative to Q2 2025 revenues of $8,021,072 and 29% relative to Q3 2024 revenues of $6,406,528.

Article content

Article content

Article content

Article content

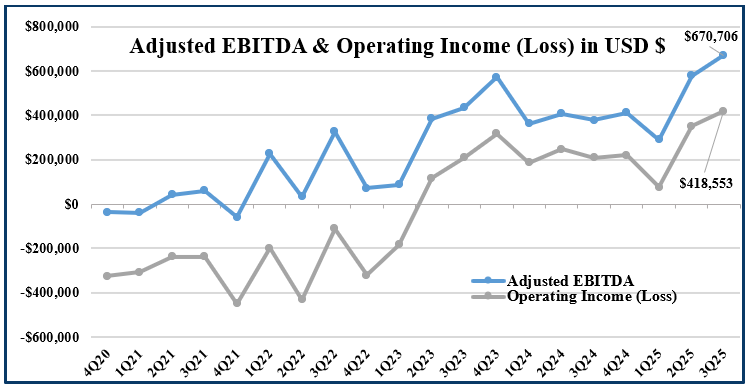

- Q3 2025 Adjusted EBITDA of $670,706 was an increase of 16.1% over Q2 2025 Adjusted EBITDA of $577,907 and 76.9% over Q3 2024 Adjusted EBITDA of $379,116 (see calculation of Adjusted EBITDA below).

Article content

Article content

- Gross profit margin as a percentage of revenues remained strong at 39.6% in Q3 2025. Gross profit margin percentage was 40.2% in Q2 2025 and 38.0% in Q3 2024.

- The Company generated income from operating activities in Q3 2025 of $418,553, an increase of $68,114 from Q2 2025 and $210,443 from Q3 2024.

- The Company recorded net income of $426,171 in Q3 2025 as compared to a net loss of $484,008 in Q2 2025 and a net loss of $207,871 in Q3 2024.

- The Company had available cash of $1,571,716 as of September 30, 2025 as well as full access to the unutilized revolving credit facility of $1,077,509 (CAD$1,500,000).

- The Company had total demand loans and promissory notes outstanding as of September 30, 2025 of $2,300,800, representing a leverage ratio of 1.18 times to trailing twelve month Adjusted EBITDA for the period from October 1, 2024 to September 30, 2025 of $1,950,620.

- As of the current date, the Company has access up to $4,691,000 in available credit for business acquisitions through its existing credit agreement to support its long-term growth strategy.

Article content

Article content

President & CEO’s Comments

Article content

“Q3 was another record-breaking quarter for Nova Leap,” said Chris Dobbin, President & CEO. “Following the strongest results in our history last quarter, we delivered new highs again in Q3, setting nine financial records, including record consolidated revenues, gross margin, and Adjusted EBITDA. These results reflect consistent execution, operational discipline, and the strength of our team across North America. The momentum across our operations is both real and measurable.

Article content

From Q2 2023 through Q1 2025, Nova Leap averaged just over $400,000 in quarterly Adjusted EBITDA. That benchmark has now been materially reset. With Adjusted EBITDA of $578,000 in Q2 and $671,000 in Q3, we have established a new level of performance materially higher than before. The results speak for themselves — our model is scaling, margins are expanding, operating leverage is becoming evident and performance has reached record levels. Adjusted EBITDA for the first nine months of 2025 nearly equals our total for all of 2024, underscoring the strength and sustainability of this year’s performance.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)