Article content

(Bloomberg) — A spate of hedge funds and asset managers are diving into the $1.3 trillion CLO market with debut vehicles, fueling demand for new leveraged loans and pushing up prices for older ones.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Macquarie Asset Management sold its first US collateralized loan obligation earlier this month, while hedge fund Arini, run by former Credit Suisse Group AG star trader Hamza Lemssouguer, priced its debut US CLO in April. Anthelion Capital, an AI-based asset management platform, is also looking to come to market in the next few weeks, and has tapped Natixis SA to help arrange the deal, people with knowledge of the matter said.

Article content

Article content

Fresh cash is helping drive up demand for the limited number of leveraged loans Wall Street banks have brought to market in recent weeks amid the tariff-induced volatility. That includes a $2 billion loan supporting QXO Inc.’s acquisition of Beacon Roofing Supply Inc. that drew so much interest it was upsized to $2.25 billion. A loan to American Airlines Group Inc. was similarly increased by 25% to $1 billion last week.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Demand from CLOs, along with easing trade tensions, is also pushing loans on the secondary market higher, with the average price climbing above 96 cents on the dollar in recent days, from below 94.5 cents a little over a month ago, according to Bloomberg index data.

Article content

“It really feels like we’re back in the situation where demand for CLO debt is going to outpace supply,” said PineBridge Investments’ Kevin Wolfson, who manages the firm’s CLO portfolio. “From a loan supply perspective, unless we really see a material pickup in new issue loan supply, CLOs are going to have to turn to the secondary market.”

Article content

CLOs, bundles of junk-rated debt that are sliced into bonds of varying risk and return, are the biggest buyers of leveraged loans, scooping up about two-thirds of all deals in the US.

Article content

Article content

Vivek Bommi, head of leveraged credit for Macquarie Asset Management, said in an interview that the recent bout of volatility wasn’t a deterrent for the firm as it rolled out its debut US product.

Article content

“There’s a difference between volatility and economic stress,” he said. “Volatility is very good because you’re able to actively manage and generate performance.”

Article content

Mehdi Kashani, Arini’s head of structured credit, was also unfazed. “The loan market had actually sold off quite a bit, and we were able to source good quality assets at great prices.”

Article content

Representatives for Anthelion and Natixis declined to comment.

Article content

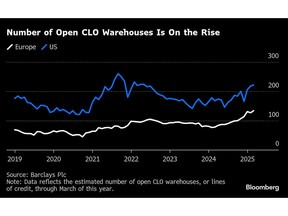

More CLOs seem to be teeing up, which is also helping demand for leveraged loans. There’s been a steady increase in the number of temporary lines of credit, known as warehouses, that collateral managers use to accumulate assets before launching their products. Open warehouses are running well above their historical average in the US and are at a record in Europe, according to data from Barclays Plc.

Article content

Notable money managers to register debut warehouses in Europe this year include Silver Point Capital, Diameter Capital Partners and Elmwood Asset Management.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)