Jul 28, 2025, 08:04:37 AM IST

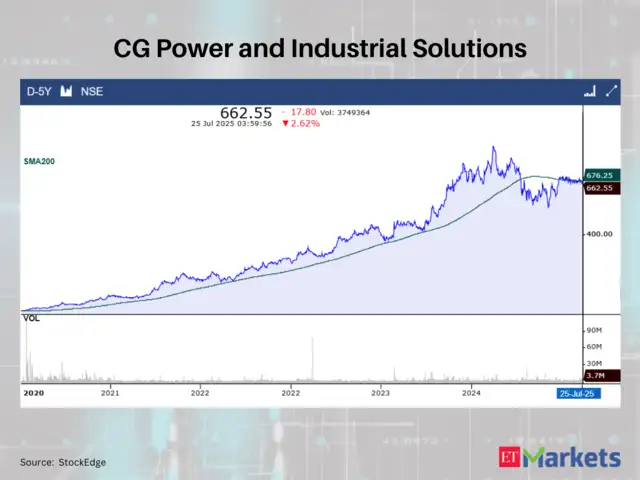

In the NSE large cap pack, 8 stocks' close prices crossed below their 200 DMA (Daily Moving Averages) on July 25, according to stockedge.com's technical scan data. Trading below the 200 DMA is considered a negative signal because it indicates that the stock's price is below its long-term trend line. The 200 DMA is used as a key indicator by traders to determine a particular stock's overall trend. Take a look:

Getty Images

2/9

Adani Energy Solutions Ltd.

200 DMA: Rs 839.3| LTP: Rs 817.15

ETMarkets.com

3/9

CG Power and Industrial Solutions Ltd.

200 DMA: Rs 676.25| LTP: Rs 662.55

ETMarkets.com

200 DMA: Rs 187.19| LTP: Rs 183.51

ETMarkets.com

200 DMA: Rs 624.78| LTP: Rs 615.85

ETMarkets.com

200 DMA: Rs 2,302.35| LTP: Rs 2,274.6

ETMarkets.com

200 DMA: Rs 447.35| LTP: Rs 443.55

ETMarkets.com

8/9

Samvardhana Motherson International Ltd.

200 DMA: Rs 100.8| LTP: Rs 100.34

ETMarkets.com

200 DMA: Rs 1,283.23| LTP: Rs 1,279.4

ETMarkets.com

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)