Article content

- Bankruptcy-related inquiries surge 17% in Q3, signaling families exhausting options as debt compounds beyond mortgage payments

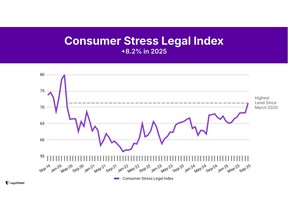

- Consumer Stress Legal Index sees highest level since March 2020 – legal stress steadily climbing going on seventh consecutive month; alarming trend headed into the holiday season

- “If the pattern holds, we’re likely to see a significant spike in actual bankruptcy filings in the first quarter of next year,” predicts LegalShield’s senior data analyst

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

ADA, Okla. — Consumer legal stress hit its highest level in nearly five and a half years, driven by a 17% surge in bankruptcy inquiries to LegalShield’s network of provider lawyers during the third quarter.

Article content

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The LegalShield Consumer Stress Legal Index (CSLI) rose to 71.2 in September from 68.2 in June, up 26.3% from its December 2021 post-COVID low of 56.4. The index has climbed steadily for seven consecutive months.

Article content

Matt Layton, LegalShield senior vice president of consumer analytics, who analyzes consumer legal trends across more than 36 million calls dating to 2002, said the timing of the surge is particularly concerning.

Article content

“We’re seeing families hit crisis mode heading into the holiday season,” said Layton. “The question now is whether this consumer legal stress translates into a pullback in spending in the final quarter of 2025.”

Article content

LegalShield’s data comes from more than 150,000 monthly calls to provider law firms across the country — real actions people take when facing financial and legal challenges, not surveys measuring sentiment. The CSLI is a composite index built from three subindices: Bankruptcy, Foreclosure and Consumer Finance, derived from more than 36 million records dating to 2002.

Article content

Debt Outpaces Relief: Bankruptcy Calls Jump 17% in Q3

Article content

Bankruptcy-related inquiries jumped 17% in the third quarter and 14% year over year.

Article content

Christopher Peoples, a LegalShield provider attorney in Kansas with Riling, Burkhead, & Nitcher, who counsels dozens of families in financial distress each month, said the debt is no longer confined to mortgages.

Article content

“We’re seeing a spike in bankruptcy-related calls here in Kansas,” said Peoples. “I’ve talked to my legal colleagues in other states like Utah and Idaho and they’re saying the same thing. People are drowning in this economic state we’re in – so much to pay for with prices constantly increasing and credit cards with exorbitant interest rates, everyday Americans are running out of options. Bankruptcy is their last lifeline.”

Article content

According to the Federal Reserve, 4.4% of outstanding debt went delinquent as of June—up 0.1 percentage point from the first quarter. The increase came primarily from delinquent mortgages, home equity lines of credit (HELOCs), and student loans, signaling growing financial pressure on American households.

Article content

This trend is reflected in LegalShield’s Q2 Foreclosure Index, which jumped 13.0% quarter-over-quarter and 28.9% year-over-year. Property data firm ATTOM reported that foreclosure filings rose 11% in July compared to the previous month and 13% compared to July of the prior year. August filings remained elevated, down just 1.1% from July but up 18.1% year-over-year, indicating sustained financial stress among homeowners.

Article content

Article content

Given that LegalShield’s bankruptcy data historically leads actual filings by two quarters, Layton predicts a difficult start to 2026.

Article content

“If the pattern holds, we’re likely to see a significant spike in actual bankruptcy filings in the first quarter of next year,” said Layton.

Article content

Broader Economic Pressures on Households

Article content

The surge in bankruptcy-related inquiries reflects broader economic challenges squeezing American families. Job losses, rising prices, and high borrowing costs are creating a perfect storm of financial pressure.

Article content

Jobs:

Article content

U.S. companies eliminated 32,000 jobs in September, according to ADP—adding to household financial anxiety as families face reduced income.

Article content

Inflation:

Article content

Prices continue climbing, with inflation reaching 2.9% in August. As everyday costs rise, families are increasingly turning to buy-now-pay-later loans just to cover groceries and essentials. A

Article content

Article content

found that half of these consumers are missing payments on these loans.

Article content

Interest Rates:

Article content

While the Federal Reserve cut rates in September for the first time since December 2024, borrowing costs remain significantly higher than before the pandemic. This means families already struggling with debt are getting little relief, even as they take on more credit to make ends meet.

Article content

KEY RESEARCH FINDINGS

Article content

Consumer Stress Legal Index (CSLI): Highest Since March 2020

Article content

- Current Level: 71.2

- Q2 2025: 68.2 | Q3 2024: 68.0

- Growth: +4.4% QoQ | +4.7% YoY

- 2025 Trend: Up 8.2% year-to-date with seven consecutive months of increases

Article content

Bankruptcy Index: Soars 17% in Q3

Article content

- Current Level: 37.7

- Q2 2025: 32.1 | Q3 2024: 33.1

- Growth: +17.4% QoQ | +13.9% YoY

- Key Insight: Bankruptcy inquiries continue upward trend since December 2021. LegalShield’s Bankruptcy Index historically leads actual bankruptcy filings by two quarters.

Article content

Foreclosure Index: Decline Masks September Spike

Article content

- Current Level: 45.8

- Q2 2025: 46.8 | Q3 2024: 42.1

- Growth: -2.1% QoQ | +8.8% YoY

- Key Insight: Index eased in July and August before jumping 4 points in September to 45.8. The Foreclosure Index closely tracks national foreclosure filing trends.

Article content

Consumer Finance Index: Steady Pressure

Article content

- Current Level: 108.3

- Q2 2025: 106.4 | Q3 2024: 108.7

- Growth: +1.8% QoQ | -0.4% YoY

- 2025 Trend: Up 9.0% year-to-date as consumers seek legal help with debt disputes and negotiations

Article content

Study Methodology

Article content

LegalShield tracks an average of 150,000 monthly calls to provider lawyers based on more than 90 areas of law. That data comprises more than 36 million consumer requests for legal services dating to 2002. The CSLI is the flagship index reporting consumer stress, based on three subindices: Bankruptcy, Consumer Finance, and Foreclosure.

.jpg) 9 hours ago

3

9 hours ago

3

English (US)

English (US)