Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

- FIIs’ India view

- Mutual fund purchases

- Cables and wires

Article content

Article content

Good morning, this is Chiranjivi Chakraborty, an equities reporter in Mumbai. Indian shares are set to post their third straight week of losses, a streak not seen since early March. High valuations aren’t helping, and a disappointing earnings season, especially from the IT sector, is pushing the recovery timeline out further. All eyes are now on Reliance Industries, which is set to report its first-quarter results later today. Meanwhile, solar stocks might take a hit as US rivals call for tariffs on imports.

Article content

Article content

Indian stocks lose their shine

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Back in April when President Donald Trump stunned markets from Tokyo to New York by announcing higher tariffs on allies and rivals, India’s domestic-centered economy was a seen as a safe haven by global investors. That enthusiasm has started to fade. Citigroup Inc. has downgraded the nation’s stocks to neutral from overweight, citing slow earnings and rich valuations. It’s not just Citi. In the latest Asia fund managers’ survey by Bank of America, India has also slipped down the list of most favored markets in the region.

Article content

Mutuals funds go on spending spree

Article content

Indian mutual funds are putting their cash to work at the fastest pace since the height of the pandemic. According to Elara Securities, actively managed fund plans saw a 1.3 percentage point-decline in cash levels — the quickest deployment rate since July-August of 2020. A big chunk has been funneled into the booming primary market, Elara says. While India’s secondary market has been most flat in recent months, the IPO scene is buzzing, with the recent strong debut of this year’s largest offering by HDB Financial Services supporting the momentum.

Article content

Article content

Data center boom drives surge in cable demand

Article content

India’s $10 billion cables and wires industry is gearing up for strong growth, with analysts at JM Financial projecting a 12% compound annual growth over the next three years. A mix of rising investments in renewable energy and a major expansion in data centers in driving this surge. Large players like UltraTech and the Adani Group are also stepping into the space — a move seen likely squeezing out smaller, unorganized players, while giving organized producers a boost. JM Financial’s top picks are: Polycab, KEI Industries, and RR Kabel.

Article content

Analysts actions:

Article content

- AWL Agri Business Raised to Hold at KR Choksey; PT 265 rupees

- Cummins India Cut to Neutral at Sushil Finance; PT 3,623 rupees

- LT Foods Cut to Hold at Mirae Asset Securities; PT 516 rupees

Article content

Three great reads from Bloomberg today:

Article content

- Meta Hires Two Key Apple AI Experts After Poaching Their Boss

- Crypto Market Gets Major Win as Congress Passes Stablecoin Bill

- Big Take: Jane Street’s Secrets Spill Into Open and Face Rivals’ Scrutiny

Article content

And, finally..

Article content

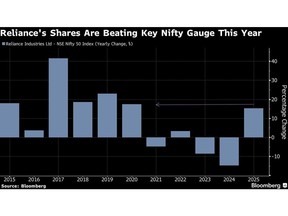

Shares of Reliance Industries are finally outpacing the country’s key benchmark index after a gap of two years. The momentum may just be getting started. With quarterly profits expected to post their steepest growth in three years, investors are now looking ahead to what’s next — particularly any hints around potential listings of its key business units.

Article content

To read India Markets Buzz every day, follow Bloomberg India on WhatsApp. Sign up here.

Article content

—With assistance from Ashutosh Joshi.

Article content

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)