Article content

(Bloomberg) —

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Article content

Article content

India’s buying of Russian crude is likely to stabilize or even decline this month, leaving more cargoes from the OPEC+ producer stranded and pushing the world’s third-largest oil importer to look to pricier alternatives.

Article content

Article content

Ship-tracking data and people familiar with the matter point to a dip that would come after imports fell in December to a three-year low. That was a third below their peak in June.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The Trump administration has attacked India for months over purchases of oil that Washington says are supporting President Vladimir Putin’s war in Ukraine, and ultimately imposed punitive 50% tariffs. Trade talks between the two sides have yet to result in a deal, and the US is now considering a sanctions bill that would slap penalties on countries buying Russian hydrocarbons.

Article content

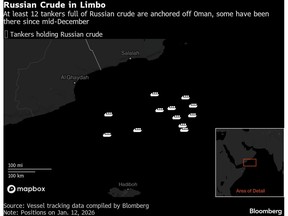

That pressure has pushed India’s refining sector — which trails only the US, China and Russia in capacity — to reduce dependence on discounted Russian feedstock. As a result, tankers laden with the unbought barrels are increasingly idling at sea with nowhere to go.

Article content

“Russia remains a core pillar in India’s slate for now,” said Sumit Ritolia, a lead analyst for refining and modeling at data analytics firm Kpler Ltd. “But buying becomes more opportunistic, more diversified, and more compliance-sensitive as geopolitics and trade mechanics continue to evolve.”

Article content

Article content

The country imported about 1.3 million barrels a day of Russian crude in December, according to data from ship-tracking firms Vortexa Ltd. and Kpler. January’s purchases are also under pressure and buying is likely to plateau at lower volumes than before, the people said, asking not to be named as the discussions are sensitive.

Article content

Kpler’s Ritolia estimated levels will likely be around 1.2 million to 1.4 million barrels a day this month. Final levels, however, could ultimately end up lower than that, the people said.

Article content

Indian refiners are adjusting their procurement patterns, becoming more active in the market for non-sensitive substitutes from the Middle East, West Africa and Latin America that can replace Russia’s flagship Urals blend, though at a higher cost.

Article content

Purchases from Saudi Arabia — the world’s biggest exporter — are higher than usual this month. Meanwhile, Indian Oil Corp., the biggest processor, recently purchased Ecuadorian Oriente crude for late March delivery in a rare transaction and issued two tenders this week with the option to purchase so-called sour grades that are closer in quality to Urals.

.jpg) 1 hour ago

4

1 hour ago

4

English (US)

English (US)