Article content

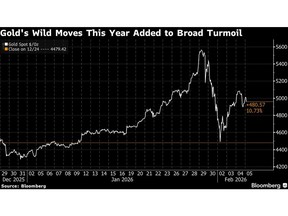

(Bloomberg) — Extreme market swings from metals to currencies are fueling a hiring push at hedge funds and banks as they seek traders who can capitalize on surging volatility.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Among the prime targets for multi-strategy firms are specialists in so-called volatility arbitrage, a way to profit from the difference between the price swings the market expects and those that actually occur.

Article content

Article content

Article content

“In the last few days these guys have printed money,” said Tony Ernest, managing partner at hedge fund talent consultant Monroe Partners Asia. “As Trump has been in the seat and the markets have been increasingly volatile, they have been in demand.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Japanese securities firms are rushing to hire currency and fixed-income traders, said the founder of a recruitment company in Tokyo. One of Australia’s largest banks, fresh off its best month for trading revenue in nearly a decade, plans to hire in areas including commodities, according to an executive who asked not to be identified discussing private matters.

Article content

These moves show the upside of a series of market tremors that have left some investors nursing heavy losses — and encouraged others to make efforts to cushion themselves against further selloffs.

Article content

The turmoil has been widespread. Gold suffered its biggest decline in four decades. Japan’s government bond market endured a $41 billion meltdown in just a few hours. The dollar and the yen have fluctuated wildly. Indonesia’s stock market was hit by a selloff so violent that the country’s top financial regulator and the head of its stock exchange both resigned.

Article content

Article content

While volatility inevitably leaves some investors in the red, it also creates chances for swing traders and intraday specialists to make money. Rising trading volumes boost revenue for banks and brokers. Price dislocations create ways for arbitrageurs to pick up quick profits.

Article content

The recent spike in volatility has simply created more opportunities to trade, said Nick Bird, whose Hong Kong-based quant hedge fund firm OQ Funds Management oversees just over $1 billion.

Article content

Braced for Turmoil

Article content

Not everyone is so sanguine. Although most money managers are a long way from panic mode, many are bracing for more turmoil on what has already proved to be a wild year.

Article content

Australian Retirement Trust, the country’s second-biggest pension fund, is reducing its exposure to the dollar and shifted toward the euro, yen and pound, said Andrew Fisher, head of investment strategy. Debt funds in Asia including at Aberdeen Investments are looking to boost their exposure to bonds that have a lower correlation with the US.

Article content

AMP Ltd., a Sydney-based pension and wealth manager, has decided not to roll over its exposure to private credit on fears the $1.7 trillion market has become too frothy, said Stuart Eliot, head of portfolio design and management for the firm’s investment arm.

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)