Article content

(Bloomberg) — Gold advanced following a run of losses, as the market digested traders the outcome of a meeting between US President Donald Trump and Chinese leader Xi Jinping.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Bullion rose as much as 1.3%, after falling almost 5% over the previous four sessions. Trump said it was an “amazing meeting” and that China would halt rare earth controls and resume purchases of American soybeans. Xi said his country is willing to cooperate with the US in areas such as trade, energy and artificial intelligence, according to the official Xinhua News Agency.

Article content

Article content

Article content

Earlier, Federal Reserve Chair Jerome Powell downplayed the likelihood of a December reduction after a widely expected quarter-point cut on Wednesday. Still, despite Powell’s unusually direct remarks, the vote marked the third straight meeting in which officials lodged dissents against the majority decision — a run not seen since 2019.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“This looks like an early attempt to reset the US–China narrative by re-engaging selective trade channels to restore confidence,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore. “Gold is, however, still sniffing out uncertainty — pricing a soft easing bias from the Fed and lingering geopolitical risk.”

Article content

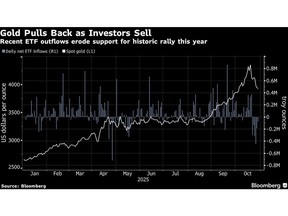

The precious metal has retreated sharply in recent days following a scorching rally that drove prices to a record above $4,380 an ounce last week. Technical indicators had shown the ascent was overheated, while growing signs of progress in US-China trade relations have eroded bullion’s haven appeal.

Article content

Still, even after its recent pullback, gold has advanced about 50% this year, supported by central-bank buying and interest in the so-called debasement trade, in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits.

Article content

“The market has experienced a natural correction, but we continue to view this bull market as incomparable with prior bull markets in terms of the breadth and depth of potential monetary demand,” Sebastian Mullins, head of multi-asset and fixed income at Schroders, said in a note.

Article content

Spot gold rose 1% to $3,968.94 an ounce as of 3:23 p.m. in Singapore. The Bloomberg Dollar Spot Index was steady. Silver rose for a third day, platinum was little changed, while palladium advanced.

Article content

.jpg) 20 hours ago

2

20 hours ago

2

English (US)

English (US)