Article content

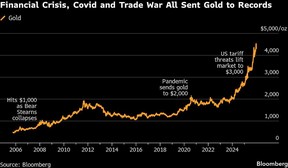

Gold and silver fell on the last trading day of 2025, though both remained on track for the biggest annual gain in four decades as a banner year for precious metals draws to a close.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Spot gold edged below US$4,320 an ounce, while silver slid toward US$70. The two have seen exceptional volatility in thin post-holiday trading, plunging Monday before recovering Tuesday and dropping again Wednesday. The big swings prompted exchange operator CME Group to raise margin requirements twice.

Article content

Article content

Article content

Both metals are still on track for their best year since 1979, supported by strong demand for haven assets amid mounting geopolitical risks, and by successive interest-rate cuts by the United States Federal Reserve. The so-called debasement trade — triggered by fears of inflation and swelling debt burdens in developed economies — has helped supercharge the scorching rally.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

In gold, the bigger market by far, those factors spurred a rush by retail investors and institutional money managers into bullion-backed exchange-traded funds, while central banks extended a years-long buying spree.

Article content

Gold is up about 64 per cent in the past 12 months. In September, it eclipsed an inflation-adjusted peak set 45 years ago — a time when U.S. currency pressures, spiking inflation and an unfolding recession pushed prices to US$850. This time around, the record run saw prices smash through US$4,000 in early October.

Article content

Article content

“In my career, it’s unprecedented,” said John Reade, a market veteran and chief strategist at the World Gold Council. “Unprecedented by the number of new all-time highs, and unprecedented in the performance of gold exceeding the expectations of so many people by so much.”

Article content

Article content

Silver has notched up a gain of almost 150 per cent during the year, driven by speculative buying but also by industrial demand, with the metal used extensively in electronics, solar panels and electric cars. In October, it soared to a record as tariff concerns drove imports into the U.S., tightening the London market and triggering a historic squeeze.

Article content

Article content

The new peak was then passed the following month as U.S. rate cuts and speculative fervor drove prices higher, and the rally topped out above US$80 earlier this week — in part reflecting elevated buying in China.

Article content

Yet the latest move swiftly reversed, with the market closing down nine per cent on Monday then swinging the following two days. In response to the extreme volatility, CME Group again raised margins on precious-metal futures, meaning traders must put up more cash to keep their positions open. Some speculators may be forced to shrink or exit their trades — weighing on prices.

Article content

“The key driver today is the CME raising margins for the second time in just a few days,” said Ross Norman, chief executive officer of Metals Daily, a pricing and analysis website. The higher collateral requirements are “cooling the markets off,” he said.

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)