Article content

(Bloomberg) — Glencore Plc’s decision to keep its stock-market listing in London shows the power of index funds.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The company said a US listing wouldn’t have increased shareholder value, with its chief executive officer noting it was unlikely the mining giant would have gained inclusion in the S&P 500.

Article content

Article content

Joining the index would require funds tracking the benchmark to buy and hold Glencore shares, bolstering the company’s valuation. Yet to be added to the S&P 500, a company must be domiciled in the US, according to S&P Dow Jones Indices, and Glencore doesn’t meet that criteria.

Article content

Article content

The decision to stay in London is “mainly since it seems unlikely it can make the S&P 500,” Chris Beauchamp, chief market analyst at IG, said in emailed comments.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Keeping Glencore is a win for the exchange, which has been losing listed companies to acquisitions amid a dearth of initial public offerings. The retention reinforces London’s attractiveness for metals and industrials companies, as it’s already drawn two fresh listings to its bourse in recent months.

Article content

Glencore is headquartered in Baar, Switzerland, and its registered office is in Jersey, Channel Islands. The company said in February it was considering moving its primary listing away from London to increase its valuation.

Article content

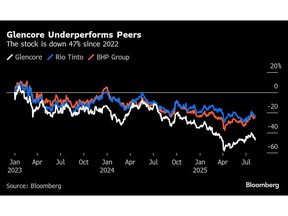

The company’s shares have fallen about 47% since 2022, underperforming peers.

Article content

Glencore’s coal-mining business, which was extremely profitable during recent energy crises, has faced criticism on environmental grounds, and has become less lucrative due to low prices.

Article content

“Rather than being a ringing endorsement of the merits of a UK listing, it may instead reflect the fact the company is not exactly in the best place to appeal to a new investor base elsewhere,” Danni Hewson, AJ Bell’s head of financial analysis, said in emailed comments.

Article content

Article content

Glencore is already listed in a natural market for a big mining company. Out of five of the world’s major diversified miners — Glencore, Anglo American Plc, Rio Tinto Plc, Vale SA and BHP Group Ltd. — only Brazil-based Vale doesn’t maintain a listing on the London Stock Exchange.

Article content

In 2021, BHP decided to unify its listing in Australia, but maintained a standard listing in London. And last year, Rio Tinto fended off a proposal by a shareholder for the company to follow BHP’s example.

Article content

Recent listings have been a boon for London’s commodities sector. Metlen Energy & Metals Plc moved from Athens at the start of this week, and Valterra Platinum Ltd., a spinoff from Anglo American, began trading in June.

Article content

For many companies, such as payments business Wise Plc and building-materials maker CRH Plc, listing in New York makes sense because they get a large proportion of their revenue from the US. British equipment-rental company Ashtead Group Plc last year noted that it is “substantially a US business” when it proposed moving its main listing. But less than 20% of Glencore’s revenue comes from the US.

Article content

—With assistance from Thomas Biesheuvel and Lisa Pham.

Article content

.jpg) 17 hours ago

1

17 hours ago

1

English (US)

English (US)