Article content

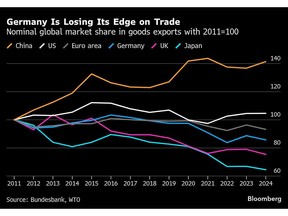

(Bloomberg) — Germany’s global export position has deteriorated substantially in recent years, according to research by the Bundesbank, which blames structural issues rather than President Donald Trump’s tariff spree.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Market shares in international trade have been declining since 2017, with the drops accelerating from 2021, economists Philipp Meinen and Arne Nagengast wrote in an article published Monday. More than three-quarters of the losses between 2021 and 2023 were due to a slump in competitiveness.

Article content

Article content

Article content

Had German exports tracked the growth of overall sales in foreign markets, output would have risen by 2.4 percentage points more between 2021 and 2024, the researchers found. Instead, Europe’s largest economy has shrunk for two straight years and may contract in 2025 and 2026 if talks with the US fail, the Bundesbank predicts. Trump says the European Union will face 30% tariffs from Aug. 1 if a better deal can’t be reached.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Chancellor Friedrich Merz has warned levies like that would rock German exporters “to the core” and could reshape his economic plans. Scaling back some of those could aggravate what the Bundesbank found were widespread losses in competitiveness that spanned many sectors and were high by international standards.

Article content

“This points to fundamental structural problems in the German economy that have weighed on many companies,” Meinen and Nagengast wrote, citing, post-pandemic supply-chain disruptions, higher energy prices, China’s emergence as a global competitor, demographics, bureaucracy and taxes.

Article content

“There’s a need to improve supply conditions in Germany,” the researchers said, suggesting fixes that include:

Article content

- Better work incentives

- Lower barriers to skilled migration

- Higher tax incentives for private investment

- Improved conditions for start-ups and research and development

- Benefits reforms

- Progress on the energy transition

- New free-trade agreements

Article content

While some government initiatives are moving in this direction, more is needed, the researchers said.

Article content

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)