Article content

(Bloomberg) — US stocks shuffled between small gains and losses on Monday, as President Donald Trump’s latest salvo of tariff threats for Europe and Mexico kept investors on edge as corporate earnings season kicks off this week.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

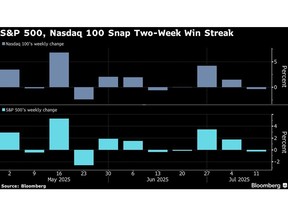

The S&P 500 Index was up less than 0.1% as of 11:30 a.m. in New York, after snapping a two week winning streak. That left the equities benchmark less than 0.3% from its July 10 record after climbing above the psychologically important 6,200 level. The Nasdaq 100 Index rose 0.2%, after falling as much as 0.5% earlier. A basket tracking so-called Magnificent Seven stocks including Apple Inc., Alphabet Inc. and Meta Platforms Inc. was flat. Nvidia Corp. came off session lows to trade 0.1% higher.

Article content

Article content

Article content

Broad losses in energy shares offset gains elsewhere in communication services companies as investors eyed further US sanctions on Russia that may affect global crude supplies, while tariff uncertainty weighed. Trump said the US would impose “secondary tariffs” of about 100% on Russian imports if deal is not reached in 50 days. Exxon Mobil Corp. and Chevron Corp. fell 1.6% and 2%, respectively.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

With key inflation data on tap this week ahead of the Federal Reserve’s July 30 interest-rate decision, money managers are focusing on earnings season after Trump said over the weekend that he plans to impose a 30% tariff on most imports from the European Union and Mexico from August 1, even as they are locked in long negotiations. Cleveland Fed President Beth Hammack said she wants to see inflation lowered further before she’d support a cut in rates.

Article content

“We are not out of the woods just yet, as the next few weeks will be pivotal to see how countries respond to the administration’s new August 1 tariff deadline,” Glen Smith, chief investment officer at GDS Wealth Management, wrote in a note. “The big question for markets in the coming weeks is if earnings, which are expected to be solid, can overshadow the tariff issues that are still there in the background.”

Article content

Article content

With punishing tariffs just two weeks away, and few countries able to sign a deal with Trump, traders are bracing for the weakest earnings season since mid-2023. Analysts see second-quarter profits on the S&P 500 rising just 2.5% year-on-year, Bloomberg Intelligence data show. the full-year growth forecast for the equities benchmark has declined to 7.1% from 9.4% in early April.

Article content

Several names are reporting soon, with results from JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. on Tuesday. Goldman Sachs Group Inc., Morgan Stanley and Bank of America Corp. report later in the week.

Article content

The latest reading on the consumer price index is on tap Tuesday. Traders will be looking for clues as to how tariffs are flowing through the economy. Retail sales figures are due Thursday and a new consumer sentiment reading from the University of Michigan — which includes data about inflation expectations — is set for release on Friday.

Article content

Wall Street strategists have been growing more optimistic about US stocks, with forecasters at RBC Capital Markets lifting their year-end target for the S&P 500 to 6,250 from 5,730, essentially bringing its forecast in line with the gauge’s close on Friday. The new level “is midway between the median and average of five different models,” strategists including Lori Calvasina wrote in a note on Sunday.

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)