Article content

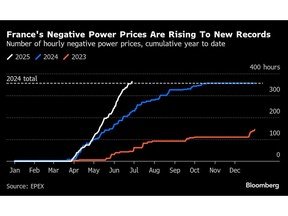

(Bloomberg) — French power prices have traded below zero for more hours this year than during all of 2024, reducing returns for investors in power generation.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

As of Monday morning, Europe’s second biggest power market has had 363 hours of negative prices this year, according to a Bloomberg analysis of EPEX Spot SE data. Neighboring markets like Germany and Spain have also seen record numbers for the season.

Article content

Article content

Article content

Negative prices are becoming a more frequent phenomenon across the region as renewable power floods the network. While that’s welcome news for many consumers, it’s decimating returns for investors. As the energy shift gathers pace, grid operators need to address the supply swings whipsawing the market.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The expectation is that there will definitely be more solar generation driven by increased installed capacity and therefore more negative prices this summer,” said Mbongeni Dube, a BloombergNEF power analyst.

Article content

It’s also a problem for France’s nuclear fleet as reactors frequently are forced to dial down output. Utility Electricite de France SA has modulated nuclear generation by about 8 gigawatts in the second quarter on a daily basis, more than double the five-year average for the same period, according to grid data.

Article content

The constant ramping up and down to account for an explosion in solar power is fueling a debate in France about whether renewables should be curbed to safeguard the viability of nuclear reactors, which account for more than two-thirds of the nation’s output.

Article content

However, with hotter weather now setting in, higher air conditioning needs could result in more solar power being absorbed by the grid, which could limit the periods of negative prices.

Article content

Advertisement 1

.jpg) 10 hours ago

2

10 hours ago

2

English (US)

English (US)