Article content

(Bloomberg) — Traders keen to seize on further gains after the S&P 500 Index hit its first record since February are betting on stock-market darlings that they expect will surpass the index’s ascent.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The signals from derivatives trading are clear, strategists said, as investors last week aggressively bought call options — a wager that an asset’s price will keep increasing. Among the highlights: a rush into Nvidia Corp. on Wednesday that pushed the volume of call contracts on the stock to almost triple that of bearish puts, the biggest gap since January; a jump to a four-month high in the call-put ratio on the Financial Select Sector SPDR Fund; and a drop to a two-month low in the cost of hedging against a selloff in Meta Platforms Inc.

Article content

Article content

Article content

To Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, the risk-on behavior has been fueled by a growing fear of missing out on a rally that seems impervious to strife in the Middle East and concern that the US economy and corporate earnings growth are slowing. In addition to Nvidia, he said there was strong call buying last week in momentum names like Uber Technologies Inc., Tesla Inc. and Robinhood Markets Inc.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The “week’s options flow reflects clear signs of FOMO-driven re-risking,” Murphy said. “The trend is clear, with almost exclusively bullish flow, momentum call buying, as well as buy-the-dip put selling.”

Article content

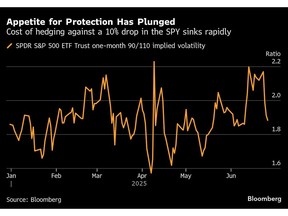

Optimism that the US is moving closer to reaching concrete deals with its major trading partners drove stocks to a record. The demand to seek protection for a decline in the largest fund tracking the S&P 500 has decreased rapidly in the past week, a move that typically implies building euphoria.

Article content

At the same time, traders are also confronting mixed signals. On Friday, US stocks nosedived in afternoon trading after Trump said he was ending all trade talks with Canada and threatened to impose a fresh tariff rate within the next week. They eventually recouped the losses and closed at an all-time high.

Article content

Article content

Earlier on Friday, Bank of America Corp. strategists warned of the increasing risk of a speculative stock-market bubble as traders drive massive flows into equities on expectations of US interest-rate cuts. The upcoming earnings season could also test the foundation of the recent rally, especially with lackluster forecasts piling in.

Article content

In a macro environment as uncertain as the current one, the possibility of more setbacks, like the souring of negotiations with Canada, are also immensely higher. It is also why Susquehanna’s Murphy said using call options is a preferred way for investors to chase speculative rallies.

Article content

It allows them to limit the size of their losses and positions them to benefit from any gains. Calls give traders the right to buy a stock at a future higher price, but does not obligate them to, which means if the bet fails, the most they lose is the premium they paid for that right.

Article content

FOMO Rush

Article content

There is further evidence that traders are crowding into the riskiest stocks seeking the sharpest upside so they don’t miss out on further gains. The Invesco S&P 500 High Beta ETF, which tracks highly volatile stocks, is on track for its best quarter since 2020 relative to the Invesco S&P 500 Low Volatility ETF. A Goldman basket of most-shorted stocks is on pace for the best monthly gain since February 2024. Retail investors are diving into equities, according to data from JPMorgan, which is often a sign of risk-taking as a stock rally intensifies.

.jpg) 7 hours ago

2

7 hours ago

2

English (US)

English (US)