Article content

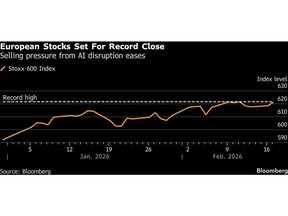

(Bloomberg) — European stocks powered ahead for a third day, reaching a fresh record, as strong earnings reports gave traders the confidence to keep rotating out of US companies and into ones from Germany, France and the UK.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The Stoxx Europe 600 Index gained 1.2% by the close. Cyclical sectors led gains, with miners, technology and energy shares the biggest outperformers.

Article content

Article content

Article content

The index has climbed 6.2% this year, with investors taking the view that Europe offers steady economic growth and cheaper valuations at a time when there’s more anxiety about US technology stocks.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Gains were more subdued in the US, where the S&P 500 rose 0.8% by the European close and is up less than 1% for the year.

Article content

Nicolas Domont, a fund manager at Optigestion in Paris, said he recently cut his US holdings to 50% from 70% and added more European shares. The latest Bank of America survey showed plenty of investors are making similar bets, with a net 35% saying they are overweight European equities relative to global markets, up from 9% just three months earlier.

Article content

“Like the rest of the market, we’re continuing to rotate,” said Domont. “The AI scare trade is creative destruction in the making and when one doesn’t know how it will unfold, one diversifies.”

Article content

Fund Managers Rediscover Bullishness for Europe: Taking Stock

Article content

Among individual movers, BAE Systems Plc gained 4.0% after saying it expects solid earnings growth, an indication that the rapid expansion of defense budgets shows little sign of abating.

Article content

Article content

The standout mover of the session was Raspberry Pi Holdings Plc, which at one stage surged as much as 33% before erasing gains. The stock has rebounded from a record low two weeks ago after a social media post highlighted that AI agents like OpenClaw could drive demand for Raspberry Pi’s single-board computers.

Article content

The AI disruption is continuing to cause some big market swings, said Francois Dossou, head of equities at Sienna Gestion in Paris.

Article content

“Yes the Stoxx 600 is at a record high, but there are very violent individual movements below the surface which blur the overall picture,” he said. “On the bright side, this earnings season has produced a real growth in profits.”

Article content

JPMorgan Chase & Co. strategists have echoed that bullishness. They expect earnings to accelerate in 2026 after a period of underperformance.

Article content

Other stock movers include:

Article content

- Bayer AG shares dropped 7.1%, the most since August, amid uncertainty around attempts to settle lawsuits tied to Roundup weedkiller.

- EssilorLuxottica SA fell 2.9%. Bloomberg reported that Apple is accelerating development on new wearable devices, including smart glasses.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)