Article content

(Bloomberg) — European stocks gained with attention turning to a slate of corporate earnings, while mixed US data boosted wagers on Federal Reserve rate cuts this year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

The Stoxx Europe 600 Index was up about 0.6% by the close. Defensive sectors such as utilities and telecoms gained the most. Energy stocks tumbled as oil fell following a report that Iran is willing to forgo nuclear weapons in a deal with the US in exchange for sanctions relief.

Article content

Article content

Deutsche Telekom AG gained 2.8% after first-quarter profit topped estimates, demonstrating the resilience of the carrier’s mobile business in its home market of Germany.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Data Thursday showed prices paid to US producers unexpectedly declined in April by the most in five years, largely reflecting a slump in margins. A separate report showed retail sales barely rose. Traders are now fully pricing in two rate cuts from the Fed by December, according to swaps data.

Article content

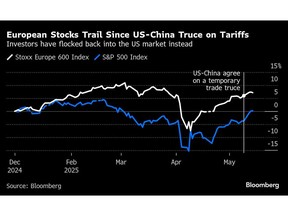

European stocks have rebounded over the past month after US President Donald Trump announced a reprieve on some tariffs. However, the benchmark had trailed US equities this week as the US-China trade truce sent investors back into American assets. The Stoxx 600 is still about 3% below its March record high.

Article content

“Investors are looking for the next catalyst to drive markets higher,” said Panmure Liberum strategist Joachim Klement. “For now, we think it is too soon to sell, but we are living in a world of maximum optimism about trade deals and tax cuts. And this optimism is unfounded in the medium term.”

Article content

In other earnings moves, shares of Ubisoft Entertainment SA, the video-game maker behind the popular Assassin’s Creed title, sank 18% as it forecast flat sales for the new fiscal year. Salvatore Ferragamo SpA shares dropped 3.1% as the Italian luxury-goods maker flagged a soft trading environment in April, with the economic outlook weighing on customer confidence. Allianz SE and Siemens AG also dropped after results.

Article content

Article content

For more on equity markets:

Article content

- Volatility Hedges Look Tempting After This Rally: Taking Stock

- M&A Watch Europe: Greencore to Buy Bakkavor; UniCredit, KBC

- Stake Sales Creep Back as Markets Stabilize Higher: ECM Watch

- US Stock Futures Fall; New Fortress Energy, CoreWeave Fall

- Burberry Slashes Staff: The London Rush

Article content

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)