Article content

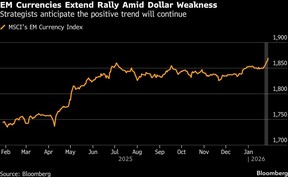

Emerging-market currencies are trading mixed after the United States Federal Reserve decided to keep rates steady, as expected, with Asian names gaining and the rest of the asset class edging lower.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The Federal Open Market Committee voted 10-2 Wednesday to hold the benchmark federal funds rate in a range of 3.5 per cent-3.75 per cent. Governors Christopher Waller and Stephen Miran dissented in favour of a quarter-point reduction.

Article content

Article content

Article content

In a post-meeting statement, policymakers said “job gains have remained low, and the unemployment rate has shown some signs of stabilization,” though Jerome Powell refrained from signalling any imminent resumption of rate cuts amid the strengthening economy.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

An index of emerging market currencies remains on track for a fifth day of advances, rising 0.1 per cent. A gauge of the dollar’s strength continued to rebound after the decision, a partial recovery after hitting its lowest level since 2022. Meanwhile, an EM stock index rallied 1.5 per cent, powered by Asian chip-makers.

Article content

“The Fed’s statement is marginally hawkish, particularly with its mention of ‘signs of stabilization’ in the labour market and an upgraded growth assessment,” said Benito Berber, chief Americas economist at Natixis. “This has resulted in a limited sell-off in LatAm FX.”

Article content

Article content

Earlier, emerging market currencies dipped after U.S. Treasury Secretary Scott Bessent poured cold water on rumours that the U.S. is going to intervene in currency markets to support the yen. When asked about potential intervention in the Japanese currency, Besset said “absolutely not.”

Article content

Article content

The remarks caused “a tactical retracement of several high-carry currencies, such as the COP and the MXN,” said Pedro Quintanilla-Dieck, a strategist at UBS.

Article content

Article content

Speculation about yen intervention coupled with U.S. policy risks have been pressuring the dollar this week, reasserting the case for investors pulling away from U.S. assets. At the same time, Trump’s relaxed tone about the dollar selloff yesterday fuelled speculation the U.S. currency is at the start of a longer-term decline.

Article content

“We anticipate this trend will continue,” said Luis Costa, head of emerging markets strategy at Citigroup Inc. EM currencies that are set to benefit from dollar weakness include South Africa’s rand, Brazil’s real and South Korea’s won.

Article content

Africa Debt

Article content

Dollar bonds issued by Kenya and Angola were outperforming emerging-market peers on Wednesday.

Article content

Moody’s Ratings upgraded its assessment of Kenya’s debt, citing a reduced risk of default in the near-term. The upgrade comes as Kenya prepares another eurobond sale, with plans to raise as much as US$2 billion. Fitch Ratings last week held its rating at B- with a stable outlook.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)