Article content

(Bloomberg) — Egypt extended a cycle of interest-rate cuts into 2026, encouraged by the lowest inflation in months and a stronger local currency.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The central bank reduced the benchmark deposit rate by 100 basis points to 19%, it said Thursday on its Facebook page. The lending rate was lowered by the same amount to 20%.

Article content

Article content

The North African nation’s second consecutive bout of monetary easing was widely anticipated, with all but one of seven economists in a Bloomberg survey predicting a 100 basis-point cut. The exception, Goldman Sachs Group Inc., expected an even deeper 150-basis-point reduction.

Article content

Article content

Trimming borrowing costs has become a focus for Egypt, which hiked them to a record in tandem with a 40% currency devaluation in early 2024 to secure a $57 billion global bailout and resolve a foreign-exchange crunch. Authorities cut rates a combined 725 basis points in five meetings last year, seeking to spur private investment seen as key to an economic revival.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

A partial taming of inflation has given the central bank leeway. After hitting a record 38% in September 2023, the headline annual figure tumbled to half that in early 2025. It slightly slowed to 11.9% in January, its lowest in four months.

Article content

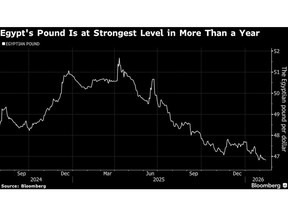

The performance of Egypt’s pound has been an added boost. It traded at about 46.83 per dollar at one point on Thursday, its strongest level since May 2024.

Article content

The International Monetary Fund, which has supported Egypt with an expanded $8 billion program, this week praised the country’s reforms.

Article content

“What they have done on the monetary-policy side is truly successful, not only liberalization of the exchange rate, but also moving towards inflation-targeting,” Managing Director Kristalina Georgieva said in an interview with Bloomberg TV in Saudi Arabia. The lender is expected to make a decision on its latest Egyptian program review in the first quarter of this year.

Article content

Article content

In cutting rates, Egyptian authorities eye a tricky balance between a figure that’s sufficiently low to reduce costly interest payments and yet high enough to keep its local debt attractive to foreign portfolio investors — an important source of funding.

Article content

“The large real-rate buffer and the benign inflation outlook will provide the CBE with enough headroom to continue its easing cycle,” Farouk Soussa, Goldman’s economist for the Middle East and North Africa, said before the decision. He sees the bank making steady cuts bringing the deposit rate to 13% by the end of the year.

Article content

Egypt saw wide-ranging changes to its government this week. While premier Mostafa Madbouly and the finance, energy and foreign affairs ministers remained in place, more than a dozen appointments included a new chief for the investment and foreign trade portfolio.

Article content

—With assistance from Abdel Latif Wahba.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)