Article content

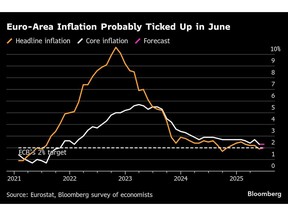

(Bloomberg) — The European Central Bank has fulfilled its inflation goal but volatility in foreign-exchange and commodities markets means the outlook for prices is murky, according to Governing Council member Gediminas Simkus.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The rapid strengthening of the euro against the dollar and moves in energy prices following tensions in the Middle East could cause inflation to deviate again from the 2% target, the Lithuanian central-bank chief said Monday in an interview. The risk of undershooting is greater than overshooting, he said.

Article content

Article content

Article content

“The inflation outlook remains fragile,” Simkus said on the sidelines of the ECB’s annual retreat in Sintra, Portugal. “We can’t be sure whether the assumptions behind our forecast will actually materialize this way.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

With inflation around 2%, ECB officials are confident they’ve met their objective. Their latest round of projections foresees price gains at the same level also in 2027, following a temporary dip below that threshold next year.

Article content

The outlook remains highly uncertain, however — partly because of geopolitical tensions and the confrontational trade policies of US President Donald Trump. Investor doubts about the dollar have also propelled the euro, which may depress import prices for the euro zone and make exports less competitive — both with disinflationary effects.

Article content

“The speed at which the euro is strengthening is something we have to monitor,” Simkus said. “In historic terms, the exchange rate isn’t out of the ordinary, but the pace of adjustment means we have to take it seriously.”

Article content

Simkus reiterated that with rates at a neutral level that neither stimulates nor restricts growth, a pause at the next meeting in July was the most likely scenario. That’s in line with the view economists who expect a final reduction only in September, after eight cuts since June 2024.

Article content

Article content

A big unknown is how the trade relationship between the European Union and the US evolves, with the two sides locked in negotiations before a July 9 deadline. Most products from Europe already face a 10% tariff on the other side of the Atlantic, however — something officials shouldn’t lose sight of despite signs of resilience, according to Simkus.

Article content

“Most of the tariff impact on the economy is undoubtedly still to come,” he said.

Article content

Live from Sintra: Bloomberg’s Francine Lacqua moderates the policy panel at the ECB Forum featuring Jerome Powell, Christine Lagarde, Andrew Bailey and Kazuo Ueda. From 2:30 p.m. London time on July 1 on Bloomberg Television, TLIV on the Terminal and Bloomberg.com.

Article content

—With assistance from Joao Lima.

Article content

.jpg) 6 hours ago

2

6 hours ago

2

English (US)

English (US)