Article content

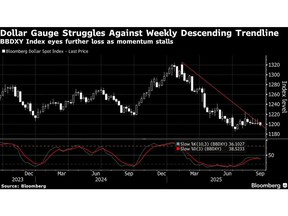

(Bloomberg) — The dollar was steady in early Asian trading as US-China trade talks entered a second day, with investors focused on this week’s Federal Reserve policy decision.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The greenback was mixed against major currencies and US equity-index futures were little changed after the benchmark S&P 500 closed flat on Friday. Asian contracts signaled declines at the open, while Japan’s markets are closed for a holiday. Oil edged lower after President Donald Trump urged Group-of-Seven allies to impose tariffs on India and China for buying Russian crude.

Article content

Article content

Article content

The key question for investors this week is whether Fed officials will push back against market bets on a series of interest-rate cuts extending into next year. In addition to the Fed’s decision on Wednesday, the Bank of Canada, the Bank of England and the Bank of Japan are also set to announce policy decisions this week.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The week is going to be all about central bank decisions. Of course, the biggest one will be the Fed, which is all but certain to cut interest rates by 25 basis points,” wrote Kyle Rodda, a senior market analyst at Capital.com in Melbourne. “The question is how aggressive the Fed is with this easing, with the markets effectively pricing in a cut at each of the final three meetings of the year.”

Article content

Traders on Monday will be closely parsing a slew of Chinese data to help gauge the health of the world’s second-largest economy. Retail sales growth may have quickened from a year ago while industrial output may have slowed, according to Bloomberg surveys.

Article content

“We expect another soft set of numbers from today’s Chinese August ‘data dump’ which can provide some temporary support for dollar-yuan,” Commonwealth Bank of Australia strategists led by Joseph Capurso wrote in a note to clients.

Article content

Article content

The US-China talks are focused on trade, the economy and the status of ByteDance Ltd.’s TikTok, which faces a deadline this week to reach a deal to continue operations in the US. Officials were also expected to lay the groundwork for a potential meeting between Trump and Xi Jinping as soon as October.

Article content

South Korean markets will also be closely watched after the country decided to keep the threshold for stock capital gains tax.

Article content

Still, the Fed’s policy meeting will remain the key focus as markets question whether officials push back against bets of easing at each remaining meeting this year. A quarter-point reduction is seen as a sure thing when the Fed announces its policy decision Wednesday, with a small potential for a half-point move amid signs US job growth is slowing rapidly.

Article content

The Fed is likely to deliver a dovish cut with at least one member in favor of a 50 basis point reduction, and new forecasts that imply a steeper easing path to guard against a weakening labor market, said Elias Haddad, a senior market strategist at Brown Brothers Harriman. “A dovish Fed policy stance can drag US dollar lower and support risk assets.”

.jpg) 3 hours ago

3

3 hours ago

3

English (US)

English (US)