Article content

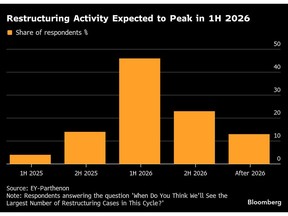

(Bloomberg) — Bankers expect debt restructuring activity to ramp up over the next six months in Europe as companies come under pressure from slowing sales, a sluggish economy and rising energy and materials costs, according to a survey by EY-Parthenon.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Almost half of restructuring professionals in the consultancy firm’s latest survey expect to see a peak in corporate restructuring situations in the first half of 2026. That marks a meaningful shift from EY-Parthenon’s March report, when a majority of bankers saw activity peaking before the end of 2025.

Article content

Article content

Article content

The later peak comes as expectations for an economic recovery in the region get pushed out and as lenders — especially private credit firms — become more picky, according to EY-Parthenon.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Some stressed companies may have been able to avoid debt restructurings this year due to an abundance of liquidity, but “funds are becoming more selective and for lower-quality borrowers it will be more expensive,” said Henry Beech, a partner in EY-Parthenon’s Turnaround and Restructuring Strategy team.

Article content

Bankers in the survey expected companies in the automotive and manufacturing sectors to see the most restructuring activity in the second half of 2025. Construction and building materials was the third group on the list, although there has been some stabilization in that industry, the report said.

Article content

Automotive companies have long been seen as vulnerable due to their high costs and thin margins, while falling demand and trade tensions have piled on more pressure this year. Among situations in the sector, Germany’s Webasto got unanimous consent last month for a restructuring deal in which lenders agreed to provide an additional €200 million ($231 million) of loans and extend €1.2 billion of existing credit lines through the end of 2028.

Article content

Read: Automotive Industry Is Most Vulnerable to Distress, Survey Finds

Article content

Competition from China, weak domestic demand and tariff pressures earlier this year have made for “a very challenging cocktail” in industries including automotives, steel and electronics, according to Ben Trask, another partner in EY-Parthenon’s team.

Article content

EY-Parthenon surveyed 191 restructuring professionals across Europe during September.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)