Article content

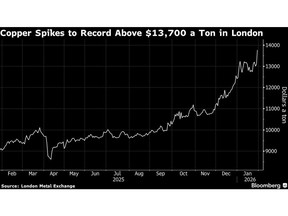

(Bloomberg) — Copper jumped to a record, as base metals extended a powerful start to 2026 on expectations for stronger US growth and more global spending on data centers, robotics and power infrastructure.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Benchmark three-month copper futures rose as much as 6.7% to $13,967 a ton on the London Metal Exchange, taking gains this year to 12%. All five of the other main metals rose, with aluminum near a four-year high and zinc gaining nearly 3%.

Article content

Article content

Article content

Commodities have stormed into the new year, aided by a sinking US dollar, rising demand for real, physical assets, and elevated geopolitical tensions as the Trump administration follows a more assertive foreign policy. In addition to copper — a material that is vital to the energy transition — precious metals have also hit all-time highs. Even crude oil, which was weighed down last year by concerns about a worldwide glut, has risen in recent weeks.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Federal Reserve Chair Jerome Powell talked up a “clear improvement” in the US economic outlook as the bank kept borrowing costs on hold on Wednesday. His tenure ends in June, after which President Donald Trump may be better positioned to step up his campaign for lower rates.

Article content

“Under the cycle in which the US maintains interest rate cuts, the expectation for upward movement in copper prices has not changed,” said Chi Kai, chief investment officer at Shanghai Cosine Capital Management Partnership. “As for how high prices can rise, there is no clear expectation as long as the US continues to push AI, chips and power construction.”

Article content

Investors have been flocking in particular to metals needed in major growth markets. Tesla Inc.’s plan to spend $20 billion this year shifting resources to robotics and AI has underscored investment prospects. Copper, aluminum and tin would all be beneficiaries.

Article content

The broad-based advance in metals came after a gauge of the US currency sank to its lowest level in more than four years, with Trump signaling he was unconcerned by the weakness. That slide makes commodities more attractive for many buyers.

Article content

—With assistance from Winnie Zhu.

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)