Article content

(Bloomberg) — Chinese steelmakers are still flooding the world with record exports, as a rising tide of protectionism is offset by resilient demand in Southeast Asia and growth in new markets in the Middle East.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

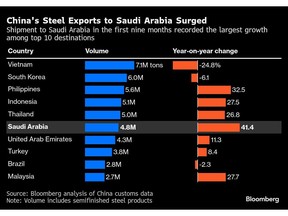

Saudi Arabia has emerged as the hot destination for 2025. Shipments of the metal to the kingdom are up 41% in the first nine months from a year earlier, the biggest jump to any major market, according to Bloomberg calculations based on Chinese customs data.

Article content

Article content

Article content

That’s helped Chinese steel mills defy expectations that they would struggle in 2025 due to rising tariffs and antidumping probes. Overall exports in the first 10 months of the year are at 97.76 million tons, surpassing the 92.05 million tons in the same period in 2024, and putting them on track for another all-time annual high.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Vietnam and South Korea, which have imposed curbs on imports of the metal from their giant neighbor, saw the biggest drops in volumes, although remained China’s top two markets. There was strong growth in the Philippines, Indonesia and Thailand, while the Middle East, and to a lesser extent Africa, emerged as new drivers of demand.

Article content

Chinese overseas investment, partially under its Belt and Road initiative, has laid the groundwork for much of this consumption. Beijing’s spending in Saudi Arabia and the United Arab Emirates has surged to a combined $86 billion over the last decade, and much of that money has flowed into steel-intensive sectors like energy and transport, according to Jing Zhang, a senior research analyst at Wood Mackenzie Ltd.

Article content

Article content

“Chinese steel export routes are shifting toward the Middle East and Africa,” she said. “The product mix reflects this shift,” with exports of steel tubes and long products that are more commonly used in infrastructure already surpassing last year’s totals, a trend that’s likely to continue, Zhang said.

Article content

Exports of long steel products to Saudi Arabia almost doubled from a year earlier, while shipments of semi-finished steel grew more than sixfold. Whether the increased demand can continue is questionable, however. The kingdom is backing away from its $500 billion plan for a futuristic city called Neom on the Red Sea, and focusing more on areas like artificial intelligence and high-tech manufacturing.

Article content

The country data, which lags behind the overall export figures, show a rerouting of steel exports to markets with fewer restrictions, according to Bloomberg Intelligence. Nations that had or are planning tariffs on Chinese steel accounted for about 45% of exports in the first nine months of this year, down from 54% in the same period 2024, BI said in a note.

Article content

For now, China’s steel export strategy is paying off. But with global trade tensions simmering and domestic demand still weak, the sustainability of the boom in shipments may depend on how long the Middle East remains a willing buyer, and if Southeast Asia can maintain robust economic growth rates.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)