Article content

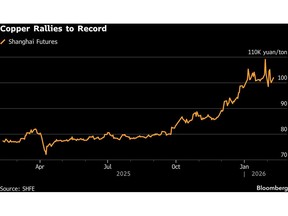

(Bloomberg) — Chinese copper buyers are extending their break over the Lunar New Year as near-record prices chill industrial demand for the metal.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The rally has “increased financial costs at copper rod and pipe producers, and reduced their order books,” said Wang Wei, general manager of Shanghai Wooray Metals Group Co., which sells refined metal to the fabricators that shape copper for factories. The Chinese holiday begins next Monday and officially ends on Feb. 23, but the lull in demand will fully take hold this week, he said.

Article content

Article content

Article content

The world’s biggest buyers of physical metal have resisted the run-up in prices over the past year due to a slowing Chinese economy. Extended shutdowns over the holiday period are likely to put a bigger dent in the market’s momentum, which saw investors drive copper to new heights at the end of last month.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Some copper rod producers in heavily industrialized southern China halted production as early as Jan. 25 and won’t restart until March, according to a survey of plants from consultancy Mysteel Global, which covered 3.3 million tons — about one-fifth — of the country’s capacity. Rod makers account for around half of China’s copper products, delivering wire for electricity transmission.

Article content

Producers of pipe, strip and plate — used in plumbing to circuit boards and solar panels — may also delay operations because of limited orders, according to the survey. The slowdown lends support to the view that speculative interest in copper, based on tightening supply and its critical roles in new energy and computing, has run ahead of real-world demand.

Article content

Fabricators and manufacturers did step in with purchases last week when prices briefly slid below 100,000 yuan ($14,400) a ton, suggesting it’s a “psychological price level that’s acceptable,” Zhou Xiao’ou, an analyst with Zijin Tianfeng Futures Co., said in a note.

Article content

Article content

If prices are below that level when industrial buyers reemerge after the Lunar New Year, the impact on demand could be significant, she said.

Article content

Inventory depletion at fabricators would also leave room for more purchases, said Fan Rui, an analyst with Guoyuan Futures Co. Other potential bright spots include front-loaded purchases from solar and battery makers, which will lose export tax rebates from April 1.

Article content

Copper futures in Shanghai rose 1.8% to 101,940 yuan a ton at 10:23 a.m. In London, they were 0.7% higher to $13,085.50 a ton.

Article content

On the Wire

Article content

Amid the wild swings in gold and silver, industrial metals tell a quieter — and more revealing — story: their once-close tie to China’s economy has frayed.

Article content

Treasury Secretary Scott Bessent cited Chinese traders as a reason behind last week’s wild swings in the gold market. China’s central bank extended its gold-buying streak to 15 months, underscoring resilient official demand.

Article content

From the way some talk about it, China sounds like a vision of a zero-carbon future.

Article content

Eight people were killed in an explosion at an animal feed factory in northern China, according to state and local media.

Article content

This Week’s Diary

Article content

(All times Beijing)

Article content

Monday, Feb. 9:

Article content

- China to release Jan. aggregate finance & money supply data by Feb. 14

Article content

Tuesday, Feb. 10:

Article content

- China’s monthly CASDE crop supply-demand report

Article content

Wednesday, Feb. 11:

Article content

- China’s inflation data for Jan., 09:30

- CCTD’s weekly online briefing on coal markets, 15:00

- CSIA’s weekly polysilicon price assessment

Article content

Thursday, Feb. 12:

Article content

- CSIA’s weekly solar wafer price assessment

Article content

Friday, Feb. 13:

Article content

- China’s home prices for Jan., 09:30

- China’s weekly iron ore port stockpiles

- SHFE’s weekly commodities inventory, ~15:30

Article content

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)