Article content

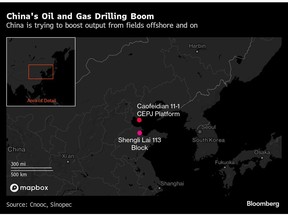

(Bloomberg) — Some 20 kilometers out from the port of Tianjin, in the jade waters of the Bohai Sea, a vast metal structure rises above the surface. This hulking offshore platform, 11-1 CEPJ, is the beating heart of the Caofeidian oil and gas field — and a monument to China’s multibillion-dollar efforts to insulate itself from the whims of its rivals.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

China has long sought to reduce the risk that comes with being both the world’s top consumer and its largest importer of energy. But the urgency and scale of that ambition have increased dramatically in recent years and months, along with geopolitical tension and the ascent of a mercurial Donald Trump to helm a US administration unafraid to use trade as a weapon. Last month, Washington also blacklisted Russia’s top two oil producers, prompting Chinese refiners to cancel some cargoes.

Article content

Article content

Article content

Since 2019, when the latest output expansion drive began in earnest, China’s majors have spent $468 billion on drilling and exploration — that’s up by almost a quarter from the previous six years, and enough to make PetroChina Co. the world’s biggest spender during that period, outpacing even heavyweights like Saudi Aramco. Production is already rebounding, and with Beijing likely to double down on self-reliance, there is no indication that pace of investment will slow in the coming years.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“In the last few years, we have seen an energy crunch all around the world,” Huang Yingchao, vice president of natural gas at PetroChina International (Singapore) Pte, the energy giant’s trading arm, said at conference last week. “Gas and LNG are like tap water and bottled water. Tap water is cheaper and is more reliable, and the logistics are easier. So we push for domestic production.”

Article content

All of this is becoming a huge, unspoken headache for the world’s largest oil and gas producers. From Exxon Mobil Corp. to BP Plc, sprawling corporations have grown used to having China as the engine for the world’s fossil-fuel demand. Indeed, for much of the last decade, it accounted for more than 60% of global oil demand growth.

Article content

Article content

Take Shell Plc, one of the world’s largest liquefied natural gas suppliers. It is investing billions into new LNG supply on the expectation that global demand will expand 60% by 2040, driven largely by China. Its boss, Wael Sawan, told a conference in June that gas could make up 20% of China’s energy mix, compared with single digits today.

Article content

“We believe China is a huge market,” Hassan Alyami, vice president of Aramco’s Ras Tanura refinery said at an industry gathering last month. “Demand is increasing. Maybe now it is stable, but in 2027 and beyond, demand is going to increase.”

Article content

But the past may no longer be a good way of predicting the future. Domestic output is increasing just as demand growth slows, with the economy sputtering and cleaner cars beginning to rule the roads. This year has already seen competition from other fuels, and Sanford C. Bernstein analysts expect domestic gas production to begin outpacing demand growth by the end of this decade, a moment when China may also be taking more pipeline gas from Russia, further cooling appetite for imported LNG.

Article content

Trump has said China will buy more US energy and even potentially invest in Alaska as part of a wider trade truce. But, as with other key areas, like agriculture, it will not be for lack of alternative options.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)