Article content

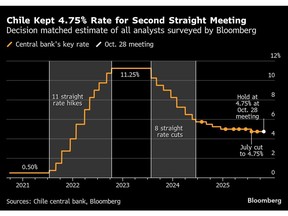

(Bloomberg) — Chile’s central bank said one board member was open to discussing a borrowing cost cut in October even as policymakers agreed there were continued inflation risks, according to the minutes to its last policy meeting.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Lingering threats to the consumer price outlook warranted gathering more information before advancing with monetary easing, central bankers wrote in the minutes to its Oct. 28 decision, when they held borrowing costs steady at 4.75% for the second meeting. Important incoming data will encompass inflation and third-quarter economic growth, policymakers wrote.

Article content

Article content

Article content

While policymakers agreed that the only “plausible” option at the meeting was to hold rates steady, “one Board member noted that several factors pointed to a reduction in inflation risks, so the option of lowering the rate by 25 basis points could have been discussed, even though it would have ruled it out,” they wrote in the document published Thursday.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Chile central bankers led by Rosanna Costa are sticking to their cautious stance as consumer price rises run above the 3% target and the country gears up for presidential elections. Board members recently got respite from data that showed annual inflation in October unexpectedly slowed to the lowest level since April 2021. Economists expect policymakers to cut borrowing costs by a quarter-point to 4.5% at next month’s rate decision.

Article content

Consumer prices rose 3.4% in October from the year prior, below all estimates in a Bloomberg survey of analysts that had a 3.7% median forecast. Monthly inflation was flat, and a closely-watched gauge of prices without volatile items like food and energy fell 0.1% from September.

Article content

In the minutes, one board member said that core inflation was still high and that consumer price pressures had not disappeared. Another policymaker said that, as long as data continued to come in-line with central bank forecasts, the key rate “should continue to be reduced toward a value compatible with the upper half of the range of values for the neutral monetary policy rate.”

Article content

Policymakers have estimated the neutral rate at 3.5% to 4.5%.

Article content

Chile’s first round of presidential elections will take place Nov. 16, followed by a runoff on Dec. 14. Obligatory voting rules will lead to millions more ballots being cast than in previous contests, adding uncertainty to the outcome.

Article content

—With assistance from Robert Jameson.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)