Article content

(Bloomberg) — One of Canada’s biggest institutional investors is recommending the Swiss franc, Japanese yen and gold as potential alternatives to the US dollar as President Donald Trump’s policies pressure the greenback.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

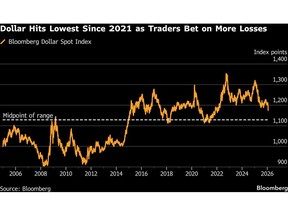

The US dollar slid even as Treasury yields rose after Trump’s April 2 tariff announcements, potentially signaling that investors no longer view the currency as a safe haven, Investment Management Corp. of Ontario said Wednesday in its annual World View report. And the dollar’s recent performance reinforces the message that the US may no longer be a stable partner, according to the pension manager.

Article content

Article content

Article content

“The acceleration in US efforts to address global imbalances, combined with Trump’s unpredictable and unconventional approach, could weigh on the USD in the years ahead while potentially lifting inflation and bond yields,” the pension said in the report. A spokesperson for IMCO said the document doesn’t necessarily indicate what actions the fund is taking on its currency exposures.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The US dollar had its steepest one-day drop since last year’s tariff rollout after Trump said on Tuesday he didn’t think the currency had weakened excessively — fueling speculation the greenback is at the precipice of a longer-term decline. Some money managers have been seeking shelter elsewhere.

Article content

In recent days, some European pension plans, such as AkademikerPension and Alecta, said that they’re cutting US Treasury holdings amid concerns that Trump’s policies have created credit risks too big to ignore.

Article content

IMCO — which manages about C$86 billion ($63.5 billion) on behalf of public-sector workers, government bodies and schools — said that, in addition to looking at other currencies, investors can consider physical assets tied to strategically vital areas such as artificial intelligence and energy-related infrastructure.

Article content

Article content

“Given that you ‘need stuff to make stuff,’ opportunities could arise in commodities, materials, energy and other natural resources as governments look to build their country’s productive capacity while securing supply chains,” the pension said in the report.

Article content

Canadian pension funds are among the world’s largest holders of US assets, meaning that unfavorable movements in the exchange rate between the loonie and the greenback can hurt investment results. More than half of IMCO’s assets were invested in the US as of Dec. 31, 2024.

Article content

The pension’s latest report for investors suggested that they can shift their geographic exposures away from the US to manage risk. Canada’s responses to US trade pressures, including a focus on big infrastructure projects, could broaden the range of investment opportunities in that country, the report said.

Article content

The biggest Canadian funds have significant investments in infrastructure around the world, including ports, renewable power, airports and energy infrastructure. Prime Minister Mark Carney’s government has launched a push to increase the country’s exports to non-US markets, and is promoting major new initiatives such as port expansions that may encourage the nation’s pension funds to invest more domestically.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)