Article content

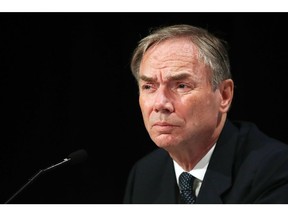

(Bloomberg) — BP Plc is considering former Centrica Chief Executive Officer Sam Laidlaw and ex-BHP Group Chair Ken MacKenzie as potential successors to outgoing chairman Helge Lund, according to Sky News, as the UK energy giant confronts mounting investor pressure and takeover speculation.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Lund, who revealed plans to step down in April, faced a significant shareholder revolt at BP’s annual general meeting, with nearly 25% voting against his re-election despite his announced departure.

Article content

Article content

Article content

The search comes amid a turbulent period for the £61 billion ($82 billion) company. BP is tussling with Elliott Management, which has built a multibillion-pound stake in the firm and is pressuring CEO Murray Auchincloss to cut spending and pivot away from renewables. The activist hedge fund has urged a renewed focus on hydrocarbons amid declining share performance — BP stock has dropped nearly 20% over the past year.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Laidlaw, who led Centrica until 2014 and more recently served on the board of Rio Tinto, is seen as a strong contender, Sky said, without saying where it obtained the information. He also chaired Neptune Energy, which was sold to Eni SpA for nearly £4 billion in 2023, and currently leads AWE, the UK’s nuclear weapons oversight body. His father, Christopher Laidlaw, previously served as BP’s deputy chairman.

Article content

MacKenzie, meanwhile, retired as chair of BHP this year. During his tenure, he dealt directly with Elliott Management, fostering a working relationship that could be valuable if selected, Sky said.

Article content

BP’s weakened market valuation has fueled speculation about potential takeover bids, with industry giants Shell and ExxonMobil reportedly analyzing the economics of a deal, though no formal moves have been made. As part of a strategic pivot, BP is also seeking to divest assets, including its Castrol lubricants unit, which could fetch around $8 billion.

Article content

BP declined to comment, while Laidlaw could not be reached for comment, Sky said.

Article content

Advertisement 1

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)