Bond traders are unwinding bets on two-year Treasury futures as lingering questions around President Donald Trump’s tariff plans cloud the outlook for inflation.

Author of the article:

Bloomberg News

Edward Bolingbroke

Published Jan 22, 2025 • 3 minute read

(Bloomberg) — Bond traders are unwinding bets on two-year Treasury futures as lingering questions around President Donald Trump’s tariff plans cloud the outlook for inflation.

Article content

Article content

Open interest, or the amount of risk held by traders, dropped in the maturity that’s most sensitive to the Federal Reserve’s policy path for five straight sessions through Tuesday. It’s sunk to the lowest level since the March contract became the most-traded maturity, back in November. The combined amount of position trimming since Jan. 14 amounts to about $5.8 million per basis point, or roughly $32 billion of cash two-year notes.

Advertisement 2

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The pullback has come as the focus on the president’s tariff proposals has intensified. On Tuesday, Trump widened his tariff threats to include China and the European Union, after taking aim at Canada and Mexico the prior day, when he took office. However, after promising steep levies during his campaign, he has yet to impose any.

The ultimate levels the administration decides on, and the pace at which they take effect will be key to how markets assess their inflationary impact and the timing and magnitude of any additional Fed interest-rate cuts. Worries that the tariffs could reignite inflation have helped push wagers on further Fed easing out to mid-year.

The dumping of positions in two-year futures has resulted from a mix of both short covering and the liquidation of long positions during a volatile stretch when markets absorbed the tariff comments, cooler-than-forecast inflation data and dovish remarks from Fed Governor Christopher Waller.

In the options market linked to the Secured Overnight Financing Rate, which closely tracks Fed policy, a standout trade Wednesday targeted a scenario where the central bank doesn’t cut this year. The swaps market currently prices in about 0.40 percentage points of easing by December’s Fed meeting.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

Article content

Here’s a rundown of the latest positioning indicators across the rates market:

JPMorgan Treasury Client Survey

In the week to Jan. 21, the latest survey of JPMorgan Chase & Co. Treasury clients showed a more bullish appetite. The cohort extended outright longs by 2 percentage points to the biggest since December 2023. Short positions dropped 4 percentage points, while neutrals rose 2 percentage points.

Treasury Options Premium Favoring Puts

The premium on Treasury option hedges remains skewed toward puts, as traders pay up to hedge a bond-market selloff over a rally, with the highest premium remaining in the long bond. The skew has retreated from near the highest in the past year, however, as 10-year yields have dropped from around 4.8% seen last week to current 4.6% area. Flows Tuesday included demand for protection against a climb in yield to 4.85%, while flows last week were broadly tilted toward similar hedges anticipating higher 10-year yields.

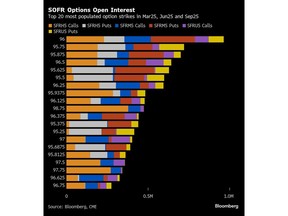

Most Active SOFR Options

Over the past week, one of the most heavily traded SOFR options strikes has been the 95.9375 level, where recent flows have included buying in the SOFR Mar25 95.8125/95.9375 call spread and Mar25 95.875/95.9375 call spreads. Also the SOFR Mar25 95.875/95.9375/96.125 broken call tree has been bought along with the Jun25 95.8125/95.875/95.9375/96.00 call condor. The 95.75 strike has also been well populated over the past week with flows including buyer of the Mar25 95.75/95.8125/95.875 call fly. Heaviest liquidation over the past week was seen in the 95.5625 strike, where a large amount of open interest in Jun25 puts was unwound.

Advertisement 4

Article content

SOFR Options Heatmap

In SOFR options out to the Sep25 tenor, the most-populated strike remains at 96.00, largely due to heavy amount of Mar25 calls and Jun25 puts at that level. Recent flows around the strike have also included buyers of the SFRZ5 96.00/96.50/97.00 call fly, while the SFRH5 96.00/96.25/96.50 call fly has also been popular. Positioning has also grown in the 95.75 strike following recent flows including buyer of the SFRH5 95.75/95.8125/95.875 call fly.

CFTC Futures Positioning

In CFTC data to Jan. 14, hedge funds covered their net short position by approximately 200,000 10-year note futures equivalents, after around 264,000 10-year note futures equivalent of short covering seen the week before. On the flip side, hedge funds unwound approximately 76,000 10-year note futures equivalents of net long positions, after around 126,000 10-year notes of long liquidation the week before.

Article content

.jpg) 2 hours ago

1

2 hours ago

1

English (US)

English (US)