Article content

(Bloomberg) — Traders are using options to bet on European Central Bank policymakers surprising markets by delivering a quarter-point interest-rate cut at some point this year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

A number of large wagers have been placed this week through options strategies tied to the three-month Euribor funding rate, which could pay out a total €32 million ($38.3 million) — or 12 times the amount paid — if the ECB cuts.

Article content

Article content

Article content

It’s a contrarian move given the ECB has long been expected to hold borrowing costs steady this year, having brought inflation just below its target. It’s expected to stay pat at its first meeting of the year next week, though policymakers now have to factor in a surge in the euro that is creating talk around the potential for further easing.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“2026 pricing looks really attractive from an asymmetric point of view,” Kim Crawford, a global rates portfolio manager at JPMorgan Asset Management, told Bloomberg TV. “The market is pricing nothing and if the ECB were to do something it would be to cut and not hike.”

Article content

While it’s common to have the odd contrarian punt in the market, a sudden flurry like this could hint at a shift in sentiment. Bets for more easing increased after a surge in the euro against the dollar prompted Austria’s central bank governor Martin Kocher to warn that rate cuts would need to be considered if the rally was big enough to lower inflation projections.

Article content

A strong currency reduces the cost of imports, which feeds through to slower price growth. The euro hit its highest since 2021 earlier this week, as concerns around US policymaking hurt the greenback.

Article content

Article content

Money markets are still only assigning around a 25% chance of a rate cut this year. They also expect a 2% ECB deposit rate to hold into early next year, extending a status quo in place since the last cut in June.

Article content

“I don’t see the ECB pivoting to a more dovish stance on the back of the euro-dollar move. I think the ECB is firmly on hold,” said Lucile Flight, managing director in rates trading at Barclays Plc.

Article content

No Hike

Article content

The options trades are unusual in that their cost has been reduced by also laying bets on policymakers not hiking rates. A 25-basis-point increase would incur losses totalling around €15 million, while a half-point of tightening would be a €35 million blow, including the premiums paid. However, most traders do not hold such positions until they expire.

Article content

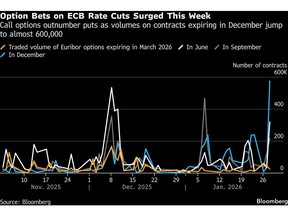

The large bets saw volumes in call and put options expiring in December jump to almost 600,000 contracts on Wednesday, more than double the next busiest day.

Article content

Some traders are also using options to bet there’ll be no change by the ECB. One is targeting rates staying on hold until the middle of this year, a wager that would return 2.5 times the €1.9 million outlay.

Article content

Barclays’ Flight said that stance made sense given there isn’t downward pressure in inflation forward markets, and the impact from energy prices would be more pronounced than from the move in the euro.

Article content

“It firmly takes rate hikes off the table. But I think moving beyond this would be unwarranted,” she said.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)