Article content

(Bloomberg) — Healthy US corporate profit growth in the latest quarter and expectations the trend will continue are strong supports for investors betting the rally in stocks will keep rolling.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

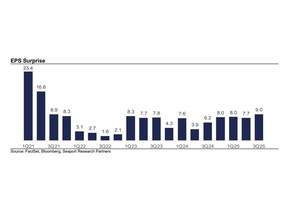

Earnings growth for the third quarter was on track to reach 13.6% year over year as of Nov. 4, near the top of its two-year range, Deutsche Bank AG strategists led by Binky Chadha and Parag Thatte wrote in a note. On a quarter-over-quarter basis, adjusted for seasonality, growth was set for a 6.5% jump, among the highest rates in the last 15 years, they added. And the momentum is carrying over into the fourth quarter.

Article content

Article content

Article content

“Either we will get upgrades or we will get strong beats” in the fourth-quarter cycle, Thatte said in an interview. He noted that the fourth quarter tends to be a strong one, given the holidays and tech buying. All told, Deutsche Bank expects 14% year-over-year earnings growth in the period.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Driving the gains are better demand in areas like artificial intelligence, power and aerospace and defense, while many companies have been able to cut costs and raise prices, according to Thatte. He sees room for stocks to run, particularly as investor positioning has stayed relatively neutral even as earnings have climbed and households are flush with cash.

Article content

Deutsche Bank has a 7,000 year-end target for the S&P 500 Index, about 4% above Friday’s close and representing a roughly 19% gain for all of 2025.

Article content

Market Breadth

Article content

Deutsche Bank’s positive view is shared by Morgan Stanley’s Michael Wilson, who sees buoyant earnings powering stock gains into 2026. He said there were “clear signs” that an earnings recovery was underway and that US firms were enjoying better pricing power. Wilson also pointed to a trough in earnings revisions, which is the number of analysts downgrading versus upgrading estimates.

Article content

Article content

Several measures show earnings growth has broadened, and that breadth is crucial for maintaining market momentum, Thatte said. More companies are growing at double-digit rates, and the number of S&P 500 sectors with earnings expansion has climbed to six from just two — mega-cap growth and tech, and financials — in the second quarter, according to Deutsche Bank.

Article content

“Growth in aggregate was doing just fine, but it was driven by tech,” he said. “That seems to have changed.”

Article content

With more than 90% of companies in the S&P 500 reporting, including those representing 83% of the gauge’s market value, data reveals stronger-than-forecast growth in the third quarter, according to Bloomberg Intelligence’s Wendy Soong. Excluding the Magnificent Seven, the rest of the 493 members came out “with flying colors,” showing earnings growth of 10.84%, double the preseason forecast of 5.28%, she found. Almost all sectors cleared the top and bottom line benchmark from the previous year, except for energy and staples.

Article content

Seaport Global Holdings LLC Chief Equity Strategist Jonathan Golub sees a similar broadening trend in corporate results. “The tech basket is very strong this quarter, while non-tech is doing insanely well,” he said in a phone interview.

.jpg) 2 hours ago

1

2 hours ago

1

English (US)

English (US)