Article content

(Bloomberg) — From defense and cybersecurity to infrastructure and healthier living, Berenberg Bank sees a widening set of sustainability winners heading into 2026.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Opportunities also are emerging in Asia and among European companies positioned to benefit from the EU’s Carbon Border Adjustment Mechanism, according to analysts Lauma Kalns-Timans and Marina Kitchen.

Article content

Article content

Article content

The focus on defense and security will become a broader theme as “threats extend beyond national borders and cyberattacks become a core business risk rather than an exception,” the analysts wrote in a report published last week. In this sector, top picks include Secunet Security Networks AG and Okta Inc.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Kalns-Timans and Kitchen expect infrastructure spending to increase this year, benefiting defense and security-related operators, transport networks and projects focused on energy efficiency and carbon reduction. In this group, the analysts highlighted Palfinger AG and Renew Holdings Plc.

Article content

Growing interest in healthier living is reshaping consumer spending that favor companies such as Technogym SpA and Robertet SA, the London-based analysts said.

Article content

As for CBAM, Danieli & C. Officine Meccaniche SpA and Befesa SA are both involved in green-steel production, which will help limit their costs tied to carbon-intensive manufacturing, Kitchen said in an interview.

Article content

And then there’s Asia.

Article content

“In our view, sustainability in Asia is a long way behind Europe,” Kalns-Timans and Kitchen wrote. “However, 2025 was a transition year, with coal emissions likely to fall for the first time in China and India in 50 years, and Asia increasing industrial decarbonisation spend.”

Article content

Article content

Progress should continue with the addition of new carbon markets in Asia, China’s 15th five-year plan and the EU’s CBAM, they said.

Article content

(For more environmental, social and governance news, click TOP ESG.)

Article content

NEWS ROUNDUP

Article content

- Green Decline | Global investment in renewable-energy projects dropped 9.5% in 2025, the first contraction in over a decade, according to BloombergNEF.

Article content

- Post-Buffett | It took just three weeks for Berkshire Hathaway Inc.’s Greg Abel to cut the final tether to one of Warren Buffett’s rare mistakes: The decade-long underperformance of Kraft Heinz Co.

- ‘Fantastic’ Rally | The manager of Janus Henderson Investors’ flagship sustainable fund said there’s little sign that US President Donald Trump’s anti-green rhetoric will derail the rally in clean-energy stocks.

Article content

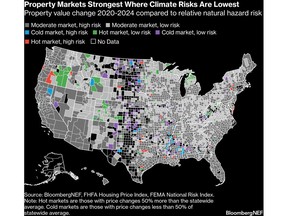

- Homes-Climate Change | US property markets are increasingly shaped by climate risk, with county-level data showing price gains concentrated in areas with lower exposure to physical climate impacts, according to BloombergNEF.

Article content

- US Bond Sale | Stichting Pensioenfonds ABP, Europe’s biggest pension fund, spent much of last year dramatically scaling back its exposure to the US government bond market.

- Transition Bonds | Transition bonds, intended to finance emissions reduction in the world’s heaviest-polluting industries, are forecast to advance this year as the overall market for sustainable instruments defies a wider climate backlash.

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)