Article content

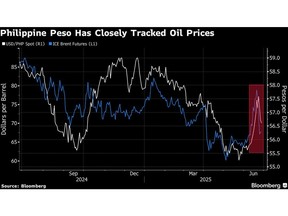

(Bloomberg) — The worst may be over for the Philippine peso as falling oil prices boost the outlook for an economy that’s heavily reliant on oil imports.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The peso, which tumbled over 3% earlier this month before trimming losses, may end this quarter somewhere around its current level of 56.5 to the US dollar, according to strategists at Australia & New Zealand Banking Group Ltd., ING Financial Markets and Wells Fargo Securities.

Article content

Article content

Article content

The peso was battered earlier in April as the outbreak of the Israel-Iran war pushed up crude prices, worsening the outlook for economies such as the Philippines that are depended on energy imports. The ceasefire between the two nations has since seen the commodity come down about 15% from its highs.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The peso’s advance is due to the reversal of oil prices,” said Wee Khoon Chong, a senior Asia Pacific market strategist at BNY in Hong Kong. “The normalization of crude oil prices is having a greater impact than domestic drivers such as dovish central bank and weakening growth outlook.”

Article content

Bangko Sentral ng Pilipinas this month cut its key interest rate for the second time this year and suggested there was scope for further easing as inflation was likely to remain modest. At the same time, policymakers said they remained “very vigilant” about Middle East developments which may spur a sharper increase in crude costs.

Article content

Broad weakness in the US dollar has also helped the peso pare this month’s losses. The greenback has faltered amid concern over America’s fiscal deficits and also due to increasing expectations for Federal Reserve interest-rate cuts.

Article content

Article content

“Our rationale for dollar depreciation stems from a Federal Reserve that is likely to cut more than markets are priced for and a US economy that is likely to slow quicker than peer economies,” said Brendan McKenna, an emerging-market strategist at Wells Fargo in New York.

Article content

President Donald Trump has said US and Iranian officials will meet this week, helping to boost optimism that the conflict won’t escalate into a wider regional war.

Article content

“We expect the risk premium from the Middle-East tensions to dissipate which will lead to a slight recovery in the peso,” said Khoon Goh, head of Asia research at ANZ in Singapore. “Broad dollar weakness” should also support the currency, he said.

Article content

This week’s main economic events:

Article content

- Monday, June 30: South Korea industrial production; China PMI; Thailand trade

- Tuesday, July 1: New Zealand building permits; South Korea trade; Indonesia PMI, CPI and trade; China Caixin PMI; Japan PMI

- Wednesday, July 2: South Korea CPI; Australia building approvals and retail sales

- Thursday, July 3: Australia trade balance

- Friday, July 4: Philippines CPI, Singapore retail sales

Article content

—With assistance from Jaehyun Eom.

Article content

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)