Article content

(Bloomberg) — Australia is weighing a price floor for critical minerals, including rare earths, to help its producers counter China’s dominance and draw foreign investment to build new mines and processing projects.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

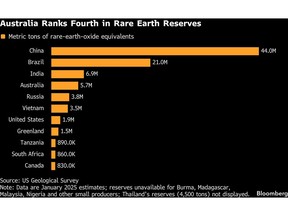

The nation, holder of the fourth-largest rare earth reserves, is among countries weighing a minimum price for the critical minerals used in everything from defense industries to tech firms to help producers compete in a market saturated by Chinese supply.

Article content

Article content

Article content

The policy would rely on support from Export Finance Australia, the government’s export credit agency, Resources Minister Madeleine King said at a press conference in Washington DC, where representatives from multiple countries gathered for a Trump administration–convened summit on critical minerals.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“We will work to make sure Export Finance Australia has the right financial tools to be able to introduce price floors,” she said. Australia was well behind China in processing and refining of rare earths and would need to work hard to catch up, King said, adding that the country’s resources industry has always depended on foreign investment.

Article content

The move comes just a day after US President Donald Trump announced plans to launch the so-called Project Vault, a strategic critical-minerals stockpile with $12 billion in seed money to slash America’s reliance on Chinese rare earths and other metals. China has a near-monopoly over processed critical minerals and has previously used supply as leverage during trade disputes.

Article content

The European Union will pitch the US on a critical minerals partnership to curb China’s influence, looking to shape the Trump administration’s push to strike global agreements this week.

Article content

Article content

Like the US, Australia is planning to build its own critical minerals stockpiles, albeit smaller at A$1.2 billion ($843 million). The government will initially focus on purchasing rare-earth elements, antimony and gallium. The effort sits alongside a landmark pact Australia signed with the US in 2025 to boost America’s access to rare earths and other minerals.

Article content

Meanwhile, as part of the sales pitch, the government has launched an online prospectus outlining 49 mines and 29 processing facilities “ready for investment,” according to King, adding that investment could take the form of offtake agreements.

Article content

The US last year offered to guarantee a price floor to one key producer, but that has so far has not been extended to any other companies.

Article content

Shares of Sydney-listed critical minerals companies rallied on Wednesday. Lynas Rare Earths Ltd. soared as much as 6.9%, Iluka Resources Ltd. advanced 5.2%, Arafura Rare Earths Ltd. climbed 6.3% and Sunrise Energy Metals Ltd. jumped 10% during morning trade.

Article content

—With assistance from James Mayger and Martin Ritchie.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)