Article content

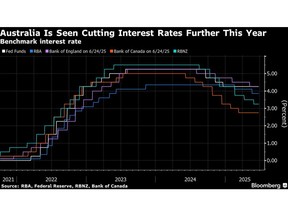

(Bloomberg) — A gauge of Australia’s monthly inflation cooled faster than anticipated in May, moving close to the bottom of the Reserve Bank’s 2-3% target and bolstering the case for further interest-rate cuts.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The Consumer Price Index indicator advanced 2.1%, compared with economists’ estimate of a 2.3% gain, data released by the Australian Bureau of Statistics showed on Wednesday. The headline figure has now been inside the RBA’s target for 10 months.

Article content

Article content

Article content

The trimmed mean measure, which smooths out volatile items such as food and energy and is the focus of the RBA’s attention, rose 2.4% in May from 2.8% in the prior month. The central bank has been monitoring core inflation as government rebates and subsidies have helped hold down the headline figure.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“This is the lowest annual trimmed mean inflation rate since November 2021,” Michelle Marquardt, ABS head of prices statistics, said in a statement.

Article content

The policy sensitive three-year government bond yield edged down slightly while traders boosted bets for a July rate cut to about 90% from just above 80% prior to the release. The RBA next meets on July 7-8.

Article content

The RBA cut its cash rate by a quarter-percentage point last month to 3.85%, its second reduction for the year, as policymakers see diminishing risks of another burst of price pressures. Governor Michele Bullock signaled after the decision that she’s more concerned about downside threats to economic growth as trade turmoil and geopolitical upheaval come to the fore.

Article content

While the monthly gauge isn’t as comprehensive as the quarterly data that guides central bank policy, it nonetheless gives RBA officials a sense of the trajectory of consumer prices. Still, with the Trump administration’s tariff regime threatening global activity, inflation is likely to begin to take second place to concerns about the economic outlook.

Article content

Wednesday’s report also showed:

Article content

- The largest contributor to the annual change was food and non-alcoholic beverages, up 2.9%, followed by housing, up 2%, and alcohol and tobacco

- Electricity prices fell 5.9% in the 12 months to May, compared to a 6.5% fall in the 12 months to April

- Rents rose 4.5% in the 12 months to May, following a 5% rise in the 12 months to April. This is the lowest annual growth in rental prices since December 2022

Article content

—With assistance from Shinjini Datta.

Article content

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)