Article content

(Bloomberg) — Rich Asian investors are plowing record money into complex stock bets that saddled them with big losses just a few years ago.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

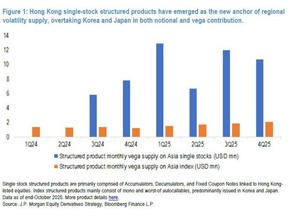

Issuance of structured products linked to Hong Kong and Singapore equities has surged 80% this year to a record of more than $200 billion, according to estimates from BNP Paribas SA, one of the top issuers. Products known as accumulators — which make their holders continuously buy stocks at preset levels — and fixed-coupon notes that offer monthly returns are particularly popular.

Article content

Article content

Article content

The revival coincides with a surge in Asia’s equities driven by the artificial intelligence frenzy. Typically marketed by private banks to wealthy clients, structured-note bets this year have been concentrated in Chinese mega-caps such as Alibaba Group Holding Ltd. and Tencent Holdings Ltd., a shift away from US names like Nvidia Corp. The instruments help holders build exposure to stocks in a more controlled way, though their complex structure means losses can worsen under certain conditions.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Issuance was very limited for the last few years, up until September of last year,” said Tony Lee, head of global equity-derivatives strategy at JPMorgan Chase & Co., referring to notes tied to Asian stocks. “Because of the recovery of the Chinese market, the product underlyings have shifted from US stocks into Hong Kong stocks.”

Article content

While US investors’ appetite toward structured products has been growing, Asia remains the main market. More than 60% of the global sales came from the region in the first seven months of 2025, led by China and Hong Kong, according to industry data provider SRP.

Article content

Article content

The instruments generally offer a smaller maximum payout than stocks, but some investors are lured by their regular, fixed payments that are usually higher than bond yields, or by the embedded protection they offer.

Article content

Yet the risks can be overlooked: The Lehman Brothers collapse in 2008, the Covid outbreak and China’s internet crackdown that triggered a multi-year stock slump are just a few incidents that handed steep losses to investors.

Article content

Traded over-the-counter, accumulators are contracts that force investors to buy a set amount of underlying securities at a fixed price over regular intervals. In a rising market, the purchase price is usually at a discount. During downturns, however, holders are often locked into buying at above-market prices.

Article content

At CA Indosuez Wealth Management, some of the most-traded accumulators require investors to purchase double the initially agreed amount of Alibaba shares if the stock price drops more a certain amount, often between 10% and 20% of the level at the start of the investment, according to Ting May Woo, the firm’s head of advisory solutions in Singapore.

.jpg) 4 hours ago

3

4 hours ago

3

English (US)

English (US)