Article content

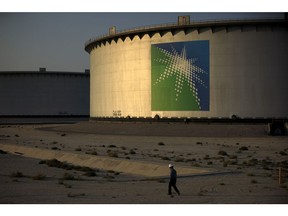

(Bloomberg) — Saudi Aramco posted a surprise increase in third-quarter profit as a production boost helped mitigate the impact of lower crude prices and snapped a years-long streak of falling earnings at the oil giant.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Adjusted net income for the period rose about 1% to 104.9 billion riyals ($28 billion) from a year earlier, surpassing analyst estimates compiled by Bloomberg. Free cash flow exceeded the total dividend payout for the first time in about two years, while net debt eased compared with three months ago.

Article content

Article content

Article content

The latest results follow a sequence of lower quarterly profit at Aramco over the past couple of years as the firm reaped the benefit of higher output in line with a more expansive OPEC+ policy, countering muted crude prices. The world’s biggest oil exporter is a lynchpin of the Saudi economy, with revenue from energy sales and hefty dividend payouts supporting the kingdom’s multitrillion-dollar economic revamp.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“For Aramco, it really does come down to volume,” said Ed Bell, acting chief economist at Emirates NBD PJSC. “There will always be a trade-off between targeting price and targeting volume. And the decision this year from OPEC+ to unwind its restraint is showing that member nations want to target volume and market share.”

Article content

Oil prices in London have declined 13% this year to about $65 a barrel, well below the more than $90 that the International Monetary Fund says Saudi Arabia needs to balance its budget. That’s translated into pullbacks in some major infrastructure and tourism projects in the kingdom, while Aramco has also slowed domestic refining and chemical plans as it focuses on a mega natural gas development.

Article content

Article content

Aramco sold its oil at about $70 a barrel in the third quarter, compared with nearly $79 a year earlier. Liquids production increased 3.8% to 10.8 million barrels a day, while natural gas output rose 5%. Aramco said overall hydrocarbon production was about 1 million barrels of oil equivalent higher daily compared with the level at the end of the first quarter.

Article content

The company’s “ability to quickly ramp-up production and capture rising demand drove our strong third-quarter performance,” Chief Financial Officer Ziad Al-Murshed said in the statement.

Article content

The shares rose as much as 1.3% in Saudi trading on Tuesday. The stock was trading near a record low in mid-September, weighed down by concerns over earnings and growth plans. They’ve increased about 12% since then, in line with the benchmark Saudi index, to narrow an annual decline.

Article content

On Tuesday, BP Plc also reported profit that exceeded expectations, backed by higher crude and gas production.

Article content

Aramco is continuing to invest in major development projects like the Jafurah unconventional gas field, which is set to start production this year and reach full capacity in 2030. The project is contributed to Aramco boosting its target for gas output to an 80% increase over levels at the start of the decade. Previously Aramco had been targeting a 60% rise.

Article content

Aramco’s free cash flow — funds left over from operations after accounting for investments and expenses — rose to $23.6 billion in the quarter. That was enough to cover the total dividend payout of $21.4 billion. The gearing ratio eased to 6.3% as of Sept. 30 from 6.5% in the previous three months.

Article content

(Updates with analyst comment in the fourth paragraph.)

Article content

.jpg) 12 hours ago

3

12 hours ago

3

English (US)

English (US)