Article content

(Bloomberg) — It was a little after 7am on a Friday in November and Stéphane Fima was already at his desk in the Société Générale tower in Paris’s La Défense business district. With the open-plan office still relatively quiet, he pulled up a confidential file codenamed “Sangria” from the bank’s servers. It was the second time in two days that Fima risked his job by accessing these documents. But with millions at stake, the acquisitions specialist couldn’t resist.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Three hours later, a burner phone registered to a fake name placed an outgoing call. The recipient was Thomas Seligman, a family friend and former hair salon mogul who founded what he claims to be France’s oldest paintball supply company.

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“They want to make the announcement in three days. You can tell him to take an extra serving,” Fima told him. “Exactly,” replied Seligman. “We’ll increase the positions.”

Article content

Over the preceding days, the banker had leaked a steady drip of details to his friend about French chemical producer Air Liquide’s plan to acquire US rival Airgas. Seligman went on to share this information with Lucien Selce, a solo trader based in Geneva who staked more than $30 million of his own money on Airgas, sometimes within minutes of getting off these calls.

Article content

Transcripts of these and additional conversations, as well as the original audio recordings, were presented in court in Paris this month as part of an insider trading trial. This story is based on that material and the indictment ordering a trial.

Article content

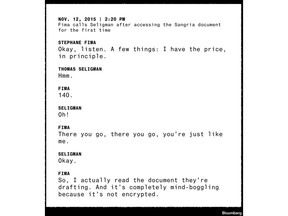

Fima’s first viewing of the Sangria document, a day before he apparently felt compelled to reopen it, coincided with the start of the heaviest trading. That afternoon, Seligman listened as Fima gave him a key piece of information: how much Air Liquide was going to pay for each Airgas share.

Article content

Article content

Within minutes of hanging up, Seligman was on the line with Selce. The paintball executive could barely contain his excitement. “It’s hot—actually, it’s not hot; it’s boiling, it’s explosive,” he said.

Article content

“The price, if you’re comfortably seated, is $140.”

Article content

“It’s worth $95,” replied Selce, referring to Airgas’s stock.

Article content

“It’s a big, beautiful deal,” Seligman said, later adding, “I think we can retire.”

Article content

That priced each Airgas share at around 40% higher than it was trading at the time, valuing the company at about $11 billion in total. The men stood to make about 40 cents on each dollar invested, which could translate into tens of millions in profits.

Article content

Selce advised Seligman to loop in “the cowboy,” the nickname they used for solo trader Alexis Kuperfis, who was apparently flying to Paris later that day. “I have a good partnership with him, as you know,” Selce explained.

Article content

Kuperfis, who denied in court being the cowboy Selce referred to on tape, or having any partnership with Selce, ended up staking more than $10 million on Airgas. Seligman also tipped off a childhood friend and a financier in Switzerland, alerting them that the Airgas tip was “coming from the place you love”—an oblique reference to Fima, according to French investigators.

Advertisement 1

Advertisement 2

Article content

That evening, Nov. 12, 2015, Fima dropped by Seligman’s home near Paris. The paintball entrepreneur phoned Selce later to share some good news.

Article content

“It’s an all-cash deal,” Seligman told the trader, making it all-but-certain that Airgas’s stock would shoot up to around the $140 target price once the news was announced. Selce, who by the end of that day would put about $16 million on the line, subsequently nearly doubled his exposure.

Article content

Four stressful days passed. Then, at about 6:30pm on Tuesday, an exuberant Seligman phoned Fima to read him a Bloomberg TV headline: “Air Liquide in Talks to Buy Airgas.”

Article content

An hour later, Air Liquide confirmed the deal, with one discrepancy—the price had ticked up to $143 a share, prompting Seligman to joke that Fima owed them the $3 difference. Between them, the four traders had made about $23 million. Selce allegedly earned $13.2 million from his trades, and Kuperfis $4.6 million off related transactions. Fima and Seligman hadn’t placed any bets, but they did expect kickbacks, according to French investigators. Fima says he was promised €100,000 (but never received it), and prosecutors claim that Seligman was remunerated in more roundabout ways.

Article content

Article content

Both Selce and Kuperfis, who were the defendants on trial in Paris this month, deny any wrongdoing. Fima and Seligman have pled guilty to charges of providing insider information.

Article content

If anything were to go wrong, one of the traders joked to Seligman right after the deal was announced, “we can hide in the Swiss Alps.”

Article content

Unbeknownst to them, something had already gone wrong—cops from the brigade financière de Paris were listening in. Suspicious trades linked to the network had attracted the attention of France’s equivalent of the US Securities and Exchange Commission. The Autorité des Marchés Financiers, or AMF, was tracing their movements and police had tapped their burner phones.

Article content

The men had reason to suspect they were being watched. A year earlier, Kuperfis was subject to a raid after he made €20 million betting on an energy deal between GE and Alstom. Around that same time, Selce sued to block the SEC from subpoenaing Google over information connected to trades he had made. AMF investigators have estimated that the pair, along with others in a wider network that spanned several countries, made roughly €100 million in 2014 alone with suspicious trading on French stocks—and hundreds of millions more over the years.

Article content

Article content

Last week, after a decade-long investigation marked by procedural delays, Selce and Kuperfis were finally summoned to trial. Some of the evidence against them had been provided by Seligman, whose lawyer declined to comment when contacted for this story.

Article content

Addressing a small courtroom in Paris filled with acquaintances and his old AMF adversaries, Selce explained that he had taken Seligman’s intel “with a grain of salt” and didn’t view it as insider information.

Article content

“I told myself that if it got to Thomas Seligman, it meant the rumor was spreading,” the 63-year-old said. “Since he knows a lot of people, it’s going to spread like wildfire, so I need to get in on it.”

Article content

By the time the Airgas deal came around, French authorities alleged, a few dozen traders including Selce and Kuperfis had netted more than half a billion euros over the previous decade by placing suspiciously well-timed bets before M&A or profit-warning announcements. And ostentatious solo traders with appetites for champagne battles in nightclubs and holidays in the French Riviera weren’t the only ones to collect. In late 2013, a contractor working on Kuperfis’ holiday home in Corsica pocketed about €6,000 trading ahead of a profit warning for carmaker Peugeot, according to French investigators.

Article content

Criminal insider trading cases are extremely rare in France, with only a handful occurring in the past decade. What makes the Airgas case exceptional even among those are the phone recordings: investigators had what they viewed as a smoking gun rather than having to rely on circumstantial evidence like call logs and financial records. They were listening in as details of the proposed merger passed from tipster to trader. They heard Seligman and Selce joke after the deal was announced. Ultimately, this enabled them to charge the men, whom they’ve described as key members of an international insider trading ring that they’d been chasing for the better part of two decades. None of the defendants at the Paris trial challenged the authenticity of the recordings.

Article content

Authorities around the world have also brought charges against other suspected participants. In 2019, a day trader and his source in London were sentenced in the UK, and a Geneva-based trader was extradited to New York, where he pled guilty to amassing $70 million in insider profits. Those cases, the first successfully brought against the alleged ring, led to additional guilty verdicts, including of a former Goldman Sachs banker, a New York restaurateur and the son of a pharmaceutical executive. In November, the Justice Department announced the indictment of a onetime Merrill Lynch banker in Paris for insider trading. While some of his supposed co-conspirators are in custody, the ex-banker, who is also under investigation in France, is now a fugitive.

Article content

Article content

All of these cases relied on tracking down the individuals who had connected leakers to traders, and in some instances, on material gathered from burner phones. Nothing, however, was comparable to the Airgas recordings.

Article content

After the Airgas deal went public in late 2015, it was time to split the profits. “We need to think about logistics,” said Selce in one of the recorded calls. Seligman had an idea. Over the following weeks, Selce wired around €725,000 to a firm developing a new paintball technology that Seligman had invested in, taking steps to make it look like a loan. (Selce denies the wire was a kickback, and says he was also an investor in the firm.) Separately, the other financier in Switzerland paid Seligman’s company about €175,000, purportedly for the right to sell the businessman’s paintball ammo in England.

Article content

Seligman’s childhood friend took an even more novel approach to remuneration. For years, Seligman had been trying to offload a Regency period console that had been a wedding gift from his parents. He’d commissioned Christie’s to sell the objet d’art, but without success. The table dropped from an estimated sale price of between €200,000-300,000 at an auction in Paris to as low as £50,000 at another in London. Still, no buyers materialized. Then, on Christmas Eve in 2015, Seligman received a wire transfer of €170,000 from his childhood friend, according to the indictment. The console was listed as the reason for the transaction.

Article content

Article content

The men didn’t have long, however, to sort out their payments. In mid-January 2016, police showed up at Seligman and Fima’s homes near Paris, and a unit combed through Fima’s office at SocGen’s headquarters. Both were taken into custody, presented with the evidence against them, and charged with sharing insider information, corruption and money laundering.

Article content

Selce and Kuperfis were charged with insider trading the following year, and forced to post bonds worth about as much as their Airgas gains. Free on bail, they remained in Switzerland and plied the court with procedural requests for almost a decade, nearly derailing the case on the grounds that investigators had illegally reviewed their phone records. Then, five months ago, an investigative judge finally ordered a trial.

Article content

On a damp Thursday afternoon in February, Selce walked the courtroom through his professional history—finance roles in Paris and London, setting up his own trading operation in Switzerland—before getting to the matter at hand.

Article content

He described how he first met Seligman in the late 1990s and the two soon became friends, even holidaying together in Corsica. Years later, Seligman mentioned he had “a friend working at a financial institution.” Tips from that mysterious banker surfaced from time to time, and weren’t always valuable. And, as far as Selce knew, they certainly didn’t come from an insider.

Article content

Selce told the judges that he’d first heard stirrings of the Airgas acquisition through a colleague in Geneva, who had spotted “technical signals” surrounding the stock. Taking a position with an exposure of $30 million on Airgas was “not extravagant at all,” Selce said, given his claim that he had as much as $50 million in disposable assets at the time. He knew he could lose a few million dollars on Airgas, “but that happened to me often,” he said, asserting he’d once lost $35 million in a single trade. (In insider trading cases, placing unusually large or erratically timed bets can be used by the prosecution as evidence.)

Article content

The years of litigation, he added, has already taken a toll. “Following extensive media coverage,” he said, “I have also been shut out of many financial institutions.”

Article content

Unlike the others, Kuperfis was not caught on tape speaking about Airgas trades. Addressing the court the following week, the 45-year-old maintained that his hands were clean.

Article content

“I’m not the cowboy, I never received any insider information either from Selce or Seligman and I didn’t decide to make this investment,” he said, asserting that his former wealth manager Thierry Braha executed the transactions on his behalf.

Article content

Article content

On Monday, Braha reiterated Kuperfis’s account, telling the court that he had staked about $10 million of his client’s money on Airgas without consulting him beforehand. He denied acting with any unusual haste or jitteriness, saying that the move was based on rumors that the firm was a target and after he had noticed an uptick in trading volume. Braha, who is accused of aiding and abetting Kuperfis’ alleged insider trading, denies having based the transactions on non-public information.

Article content

In closing arguments on Wednesday, a prosecutor for the Parquet National Financier asked for a three-year jail term and a €30 million fine for Selce. She also sought a one-year prison sentence and a €13 million penalty for Kuperfis, and a six-month sentence and €450,000 fine for Braha. The Paris criminal court said it would read out its ruling on April 13.

Article content

French investigators may not be finished. Kuperfis has been charged over suspicions he corrupted a former BNP banker to gain an advantage in trading inflation-indexed French bonds—accusations he’s fighting. When it comes to the Airgas case, his lawyers Loïc Henriot and Sébastien Schapira are content that he was finally able to explain himself on the stand after ten years of proceedings. Selce remains embroiled in a criminal case in France focusing on what authorities believe are suspicious transactions related to the attempted takeover of an oil services firm more than a decade ago.

Article content

Article content

Fima’s guilty plea in the Airgas case enabled him to avoid a trial—something his lawyer David-Olivier Kaminski said came as “a relief” to his client—and he has separately admitted to providing insider information to Seligman about the failed oil services deal, which resulted in earnings of nearly €4 million for Selce and more than €5 million for Kuperfis.

Article content

Braha told the court that his life has changed radically since the Airgas case began. He lost Kuperfis as a client, quit wealth management and moved to Dubai to work in real estate.

Article content

Seligman, who remains active in the world of paintball, once told the judge leading the Airgas investigation that he’d felt out of his depth.

Article content

“This story began more in jest than as a genuine insider trading operation,” he said. “But now that the dust has settled around Airgas, I realize that I was smack in the middle of an actual insider trade.”

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)