Article content

(Bloomberg) — For strategists at JPMorgan Chase & Co. and Goldman Sachs Group Inc. as well as money managers in Hong Kong and Singapore, an opaque term has suddenly emerged as the catchphrase for deciphering Chinese policy intentions and navigating the stock market.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

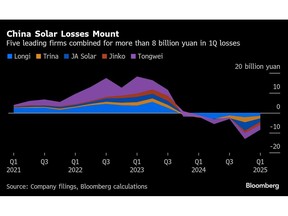

The term “anti-involution” has cropped up in government documents over the past year, but gained prominence earlier this month when President Xi Jinping chaired a high-level meeting that pledged to regulate “disorderly” price competition. It refers to efforts to root out China’s industrial malaise, marked by cutthroat price wars and overcapacity that have hurt profitability in sectors ranging from solar, new energy vehicles to steel.

Article content

Article content

Article content

Investors are hopeful that a more coordinated policy response to tackle the drivers of deflation is on its way, though Beijing hasn’t yet released any plan. Analyst reports on the theme have flooded the market, while solar and steel stocks have rallied in July. Morgan Stanley strategists changed their preference to onshore shares from those in Hong Kong last week.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“One of the biggest issues that investors have investing in China is that of excessive competition,” said Min Lan Tan, head of the Asia Pacific chief investment office at UBS AG. “It’s actually a very positive development that top down the government is now recognizing it and directly saying that destructive competition has to stop. It’s a powerful policy signal.”

Article content

The Chinese term for involution, 内卷 (neijuan), literally means rolling inwards. In practice, it’s used to describe a system of intense competition that yields little meaningful progress.

Article content

Huge spending on building capacity has helped Chinese firms enhance their global standing. The nation’s companies now dominate every step of the solar supply chain, while its EV makers have toppled Tesla’s dominance. Yet, ending destructive competition has rarely been more important. Producer deflation is worsening, and trade tensions mean China can no longer unleash some of its overcapacity to other countries.

Article content

Article content

“With foreign markets closing off Chinese trade routes, part of the competition is forced to return to the domestic market,” said Jasmine Duan, senior investment strategist at RBC Wealth Management Asia.

Article content

The campaign seems to be helping improve investor sentiment for the mainland market, where policy drivers have a stronger sway and industrial stocks have bigger weighting. The onshore CSI 300 Index has risen 2% so far in July, outperforming the Hang Seng China Enterprises Index after lagging it for most of the year.

Article content

Solar stocks Xinjiang Daqo New Energy Co. and Tongwei Co. have advanced at least 19% this month. Liuzhou Iron & Steel Co Ltd. has surged more than 50% while Angang Steel Co. has gained about 16%. Glass, cement and chemicals shares have also jumped.

Article content

It’s still early stages but if the reforms pan out, “there’ll be consolidation in China and there’ll be slightly better pricing and margins, and there’ll be better valuation,” said Wendy Liu, head of China and Hong Kong equity strategist at JPMorgan. Sectors that are likely to benefit include autos, battery, solar, cement, steel, aluminum and chemicals, she said.

.jpg) 9 hours ago

1

9 hours ago

1

English (US)

English (US)