Article content

As tensions in the Middle East mounted to start the week, Wall Street strategists had a message for equities investors: Stay calm and buy into market declines. The call looked prescient on Tuesday after U.S. President Donald Trump announced a ceasefire between Israel and Iran.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Both Paul Christopher of Wells Fargo Investment Institute and Sam Stovall of research firm CFRA suggested that long-term investors should buy information technology, communication services and financials. Dennis DeBusschere of 22V Research favoured growth and momentum stocks.

Article content

Article content

Article content

Article content

The recommendations indicate a departure from the typical wisdom offered during times of war and uncertainty, when the move is usually to dive into defensive stocks. Many strategists believe that the Iran-Israel conflict won’t have a lasting impact on stocks and that technology companies — often known for their bullet-proof balance sheets and strong cash piles — will provide shelter should tensions flare.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The historical experience thus far has been that … geopolitical risks have managed to be contained every time and the market has become accustomed to that,” Barclays strategist Venu Krishna said in an interview with Bloomberg TV on Monday. “Hence we’re extrapolating that once again.”

Article content

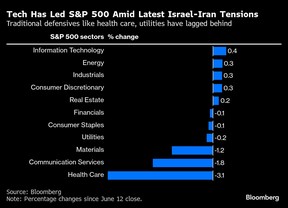

So far, traders seem to be taking note. On Monday, the S&P 500 rose nearly one per cent after a brief decline, buoyed by technology stocks, with Iran’s retaliatory strikes at a U.S. air base in Qatar seen as symbolic. Since the latest Iran-Israel strife began in mid-June, the S&P 500 has been led by the technology companies, while health-care, a defensive sector, has been the biggest decliner.

Article content

Article content

“Being defensive is betting on a market decline; that is something we don’t see happening,” said Michael Kantrowitz, chief investment strategist at Piper Sandler & Co. “As long as earnings estimates continue to grind higher, 10-year Treasury yield stays below 4.5 per cent, and oil below (US)$85, we think markets will continue to grind higher.”

Article content

Article content

The 10-year Treasury yield was trading just below 4.4 per cent on Tuesday, while West Texas Intermediate crude futures dropped to as low as US$64.4 a barrel.

Article content

Morgan Stanley strategist Michael Wilson also remained bullish, saying the U.S. involvement over the weekend was unlikely to disrupt the firm’s view that U.S. companies will experience growth in the next six to 12 months. That outlook will remain intact unless there’s a significant spike in oil prices, he said.

Article content

Still, the snag for some investors is that valuations in technology stocks — especially the largest names — have started to approach the highs they reached earlier this year, before the tariff-fuelled selloff in March and early April. Since then, as the broader market staged a recovery, tech stocks have led the way again.

.jpg) 10 hours ago

1

10 hours ago

1

English (US)

English (US)