Article content

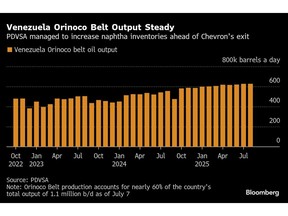

(Bloomberg) — Venezuela’s oil output has been more resilient than expected since the US forced Chevron Corp. to wind down operations in the country, with a last-minute shopping spree for a key production supply helping cushion the blow.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

State-owned Petroleos de Venezuela SA has maintained average output of about 1.1 million barrels a day in June and July, according to figures seen by Bloomberg. Chevron, which pumped nearly a quarter of Venezuela’s barrels, lost key licenses to operate in the country near the end of May as the Trump administration sought to pressure President Nicolas Maduro.

Article content

Article content

Article content

Venezuela’s production was expected to decrease shortly after Chevron’s exit because the company imported much of the diluent that PDVSA needs to help the heavy crude from the country’s Orinoco fields flow through pipelines. But the country stocked up on the material before the US deadline for Chevron to halt major works, and those stockpiles are helping prop up PDVSA’s output.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Imports of diluent soared to 97,000 barrels a day in May, the highest in more than four years, data compiled by Bloomberg show, with all of those supplies coming from the US.

Article content

With sanctions now having cut off that flow, PDVSA may have to resort to less-than-ideal alternatives to diluent naphtha, such as condensate from Iran and heavy naphtha from Russia, both of which are also subject to sanctions. The US has been considering tariffs on buyers of Russian supplies, adding another layer of risk.

Article content

A PDVSA press official did not respond to requests for comment.

Article content

Venezuela received its first cargo of naphtha since May on Saturday. A vessel is discharging 704,000 barrels of naphtha from an unknown provider in the port of Jose, according to a PDVSA document seen by Bloomberg.

Article content

Article content

Venezuela relies heavily on imported diluent because the limited amounts it produces are used to make gasoline for the fuel-starved nation, leaving 11 out of 17 fields in the Orinoco Belt dependent on imported naphtha, according to a PDVSA document. Foreign companies, including Italy’s Eni SpA and Spain’s Repsol SA, also used to help with gasoline imports to ease shortages for drivers but are now prevented from operating in the country due to the sanctions.

Article content

“It’s difficult to know how long the inventory will last,” said Francisco Monaldi, the director of the Latin American energy policy at Rice University’s Baker Institute for Public Policy in Houston. Inventories will begin to decline in the next two to three months, he added.

Article content

.jpg) 11 hours ago

1

11 hours ago

1

English (US)

English (US)