Article content

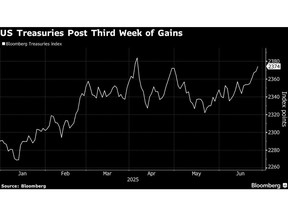

(Bloomberg) — US Treasuries closed out a third-straight positive week in a rally fueled by bets the Federal Reserve is ramping up to cut rates at least twice this year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The Bloomberg US Treasury index posted a 0.8% return for the week in its best run since early April. It’s now on track for its biggest monthly gain since February.

Article content

Article content

The advance has been driven by several economic data points that reinforced rate-cut wagers and by speculation President Donald Trump will name a more dovish Fed chief. Fed officials Christopher Waller and Michelle Bowman have also signaled in recent days they’d be open to lowering rates as soon as the next meeting.

Article content

Article content

“The market really got excited on the Fed dove narrative,” said Gregory Peters, co-chief investment officer at PGIM Fixed Income. That now “puts data more at the fore.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The gains for the week came even after the bonds slipped on Friday. Yields on maturities across the curve rose following the release of economic data that pointed to firmer-than-expected inflation.

Article content

“The market overshot a bit based on Waller and Bowman language and now we’re taking some of this risk off into the weekend,” said Ed Al-Hussainy, rates strategist at Columbia Threadneedle Investment.

Article content

A Bloomberg gauge of the dollar separately rallied to the day’s high on Friday after Trump said he would be cutting off all trade talks with Canada and threatened to impose a new tariff rate. Canadian government debt jumped on the news, outpacing developed market peers.

Article content

The market could well find further support from supply-and-demand factors including Monday’s month-end index rebalancing, which has the potential to drive buying, and from a gap in the coupon auction calendar until July 8.

Article content

Read: Jim Millstein Says US Risks ‘Fiscal Disaster’ If Recession Hits

Article content

Article content

Traders are also fully pricing in two rate cuts this year, with the first coming in September. They currently see a less than one in five chance of a July rate cut, but will focus on plenty of fresh data next week, topped by the June employment report.

Article content

That data is released Thursday ahead of the July 4 holiday. Job creation is forecast to ease to 120,000, down from 139,000 the prior month, according to economists surveyed by Bloomberg. The unemployment rate is seen nudging up to 4.3%, and while still contained, such an reading would mark a fresh peak since 2021.

Article content

“There is a little bit of optimism that rate cuts are coming, most of that is driven by governors Waller and Bowman basically referencing that July is in play,” Gennadiy Goldberg, head of US rates strategy at TD Securities told Bloomberg TV. He said the rest of the FOMC was split in two camps calling for either two or no rate cuts this year. TD expects the next rate cut to arrive in October as by that stage, the Fed will have enough data on inflation and the jobs market.

Article content

“It is going to be a drift lower in rates, and that’s why our year-end forecast for 10-years is 4%,” he said.

.jpg) 4 hours ago

2

4 hours ago

2

English (US)

English (US)