Article content

(Bloomberg) — US equities continued their slide Friday morning as traders bet that President Donald Trump’s pick to replace Jerome Powell as chair of the Federal Reserve would bring a hawkish stance to the central bank.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The S&P 500 Index declined 0.2% as of 9:35 a.m. in New York, adding to declines after Thursday’s rout. The tech-heavy Nasdaq 100 Index fell 0.4%, while the Dow Jones Industrial Average retreated 0.2%.

Article content

Article content

Article content

“The US stock market is trading lower this morning on the news that President Trump has nominated Kevin Warsh to be the next Chair of the Federal Reserve,” said Matt Maley, chief market strategist at Miller Tabak + Co. He noted the declines in the market are a function of traders’ views that Warsh “is seen as less supportive of deep rate cuts.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Trader hopes for additional rate cuts were dealt another blow after a hotter-than-expected producer price report Friday morning, reflecting higher costs for services. Markets are still pricing in a low likelihood of a rate cut at either the March or April Fed meetings.

Article content

“Financial markets are doing what you’d expect. Equity futures are down and longer-term rates are up,” Neil Dutta, head of economic research at Renaissance Macro Research, said about the reaction to the Warsh pick. Dutta sees near-term rate hikes leading to “tougher hikes later” and because “Warsh has been a policy hawk his entire life, his newfound dovishness looks very suspect.”

Article content

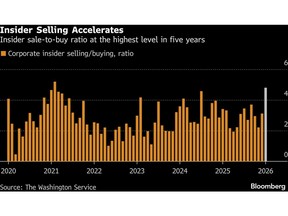

Corporate insiders have have been selling stocks at the fastest pace in five years, according to data compiled by the Washington Service.

Article content

Article content

In the tech sector, Apple Inc.’s earnings from Thursday beat expectations and provided a rosy forecast. Sandisk Corp. shares soared after the computer hardware company’s revenues beat expectations, prompting an upgrade.

Article content

The results were closely watched after competitor Microsoft Corp. posted its biggest one-day drop since 2020 on disappointing cloud revenue and higher-than-expected capital spending. It was the biggest one-day selloff in any tech stock since DeepSeek sent Nvidia Corp. shares plummeting last year.

Article content

The materials sector is expected to be in focus Friday with gold and silver prices falling sharply in the morning.

Article content

Energy, which has been the top-performing S&P 500 sector this month, is seeing some weakness Friday as oil prices slipped over concerns about a US intervention in Iran. Exxon Mobil Corp. and Chevron Corp. both reported better-than-expected earnings.

Article content

—With assistance from Natalia Kniazhevich.

Article content

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)