Article content

(Bloomberg) — Equities are headed for a blue-sky scenario after the ceasefire in the Middle East drastically reduced the odds of a major disruption to energy prices.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The risks facing the stock market are swiftly diminishing as economic growth remains solid despite the turmoil from tariffs and geopolitics. Equities have been remarkably resilient over the past two months as the S&P 500 bounced sharply from April lows, putting it 2% away from its record high.

Article content

Article content

Article content

“It’s dangerous for investors to overreact on such events which typically turn out to be entry points rather than lasting selloffs,” Barclays Plc strategist Emmanuel Cau said. “This could actually end up as a bullish factor for stocks over the medium term.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

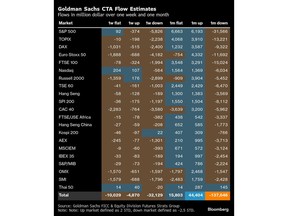

There’s enough evidence to show equity bulls have enough dry powder to lift the market even higher. Fundamental investors haven’t majorly increased exposure to equities since the April rebound, leaving them with the scope to take on more risk. Other market forces — systematic investors, option flows and retail traders — are also likely to also have a major impact.

Article content

“Market price action signaling geopolitical developments as a clearing event,” according to a note from Goldman Sachs Group Inc.’s trading desk published on Monday after Iran launched missiles at an American air base in Qatar. “Trading on our desk today was orderly — more offense than defense being played,” they said.

Article content

To be sure, the systematic cohort has been a big support for markets over the past weeks but is now a fading force, given these trend-following funds are already very long. On top of that, more corporates are heading into the buyback blackout period ahead of the second-quarter earnings season. The silver lining is systematic investors are not going to be big sellers either as long as markets stay constructive.

Article content

Article content

Meanwhile, positioning in the options market saw a reset after Friday’s $6.5 trillion expiry. That will allow stocks to move more freely as market-maker hedging flows are now at the cyclical low. Ultimately, this “translates into more organic price action in the equities market,” note the option strategists at Tier 1 Alpha.

Article content

Some areas of risk-taking are already in full swing. Renewed optimism about artificial intelligence has pushed stocks tied to the theme to all-time highs while broader stock benchmarks were in consolidation mode. This suggests that the driver which pushed markets higher over the past two years can be a bullish force once again.

Article content

Meanwhile, the threat of inflation resurgence is fading as oil prices swiftly recede, with President Donald Trump’s July 9 tariff deadline set to be the next key event dictating the path of consumer prices. Second-quarter earnings will also soon come in focus. Analysts expect S&P 500 earnings per share to grow 2.8% from a year ago, according to data compiled by Bloomberg Intelligence, but the focus will be on forward-looking commentary about how firms are navigating the trade backdrop.

Article content

“A best bull case would be one when it becomes clear that tariff pauses will be largely extended — maybe even interspersed with a deal or two — so then we can look to some of the other potential positive outcomes for upside optionality,” notes Academy Securities Macro Strategist Peter Tchir.

Article content

—With assistance from Julien Ponthus.

Article content

.jpg) 5 hours ago

3

5 hours ago

3

English (US)

English (US)